Hey Edge readers,

In this week’s issue, we take a look at one of crypto’s less discussed innovations, the Tricrypto pool. Our coverage focuses on the underlying mechanics and risks involved for liquidity providers.

Here's what we're covering this week:

- What is Tricrypto? 🔱

Learn how Tricrypto works and the key risks.

- Jupiter airdrop takes off 🪂

Airdrop stats, new Layer 2s and more.

Stay sharp. 🫡

– The Exponential team

What is Tricrypto?

Imagine an investment strategy that combines Bitcoin’s market-leading presence, Ethereum’s technological advancements, and the stability of USD stablecoins. Tricrypto pools offer just that – a balanced portfolio with 33% exposure to each of these blue-chip assets. This design not only provides a well-rounded investment portfolio but also mitigates the risks associated with single-asset volatility.

The appeal of Tricrypto

ETH, WBTC (a DeFi-friendly version of BTC), and USD stablecoins (USDT, USDC, etc.) are three of the most crucial assets in DeFi and trading between these assets account for a significant share of decentralized exchange (DEX) trading volume. Today, more than 70%+ of all DEX trading volume is in blue-chip pairs like ETH, WBTC, and USD stablecoins. More volume means more trading fees. So how can you earn a slice of these fees?

Enter Tricrypto pools. First pioneered by Curve, Tricrypto operates on a simple yet effective principle: equally distributing your investment across WBTC, ETH, and USD stablecoins. This means, as an investor, you get simultaneous exposure to the growth potential of BTC and ETH, while the stablecoin component offers a buffer against market volatility.

The unique feature of this pool is that investors are not just benefiting from the potential appreciation of BTC and ETH, but are also earning substantial yield as high as 20% APY. This dual advantage of exposure to major assets and high yield makes Tricrypto one of the more attractive and rewarding options for passive investors seeking broad exposure to crypto.

How does it work?

The Tricrypto pool is based on the automated market maker (AMM) model that enables digital assets to be traded permissionlessly and automatically by using liquidity pools. On AMMs like Curve, the pool is always trying to 'buy low’ and 'sell high’. Let’s take a look at how a user trade on Curve, would impact the Tricrypto pool:

- Initial trade: User comes to Curve to swap USDC for WBTC. Curve routes the trade through its Tricrypto pool (only if the pool offers the best available rate for USDC <> WBTC).

- Impact on pool balance: The trade alters the balance of assets in the pool. There is now more USDC and less WBTC, deviating from the targeted 33% exposure for each asset.

- Automatic price adjustment: Curve’s smart contracts automatically adjust the prices of the assets in the pool based on their current quantities.

- Incentivizing rebalancing: To restore balance, the pool will adjust the prices in a way that makes it more attractive for other traders to either sell WBTC (for ETH and USDC) or add WBTC to the pool.

What are the risks?

Besides smart contract risk, a key consideration for investors in Tricrypto pools is the concept of impermanent loss (IL). IL refers to the difference between what your value would have been had you held your crypto assets instead of depositing them into a AMM liquidity pool. Here’s how IL can affect a Tricrypto pool during large market swings:

- Initial deposit: User comes to Curve to deposit liquidity into a Tricrypto pool. Subsequently, the market experiences a significant upswing, which impacts the WBTC and ETH within the pool.

- Price discrepancy: The price of WBTC and ETH in the external market changes, but within the pool, prices adjust more slowly since they are determined by the pool’s current ratio of assets. This discrepancy creates an arbitrage opportunity.

- Arbitrage and pool rebalancing: Since WBTC’s external market price increased but is still relatively cheaper in the pool, arbitrage traders will buy WBTC from the Tricrypto pool and sell it in the external market for profit. This buying action serves to deplete the WBTC in the pool.

- Impact on investors: Your deposit is now unbalanced – you have less WBTC (which has appreciated in value) and more USDC and ETH (assuming ETH’s price hasn’t increased as much). If you chose to withdraw your liquidity at this point, you would end up with less WBTC than you initially deposited, resulting in a loss compared to simply holding WBTC outside the pool.

- Impermanent loss: IL is caused by arbitragers exploiting discrepancies between the pool’s internal prices and external market prices. This activity helps keep prices in line with the rest of the market. However, the profit arbitragers earn comes from liquidity providers. The loss is termed ‘impermanent’ because it only becomes realized when you withdraw your funds from the pool. If the prices were to revert back to their original state before you withdraw, the loss would be eliminated.

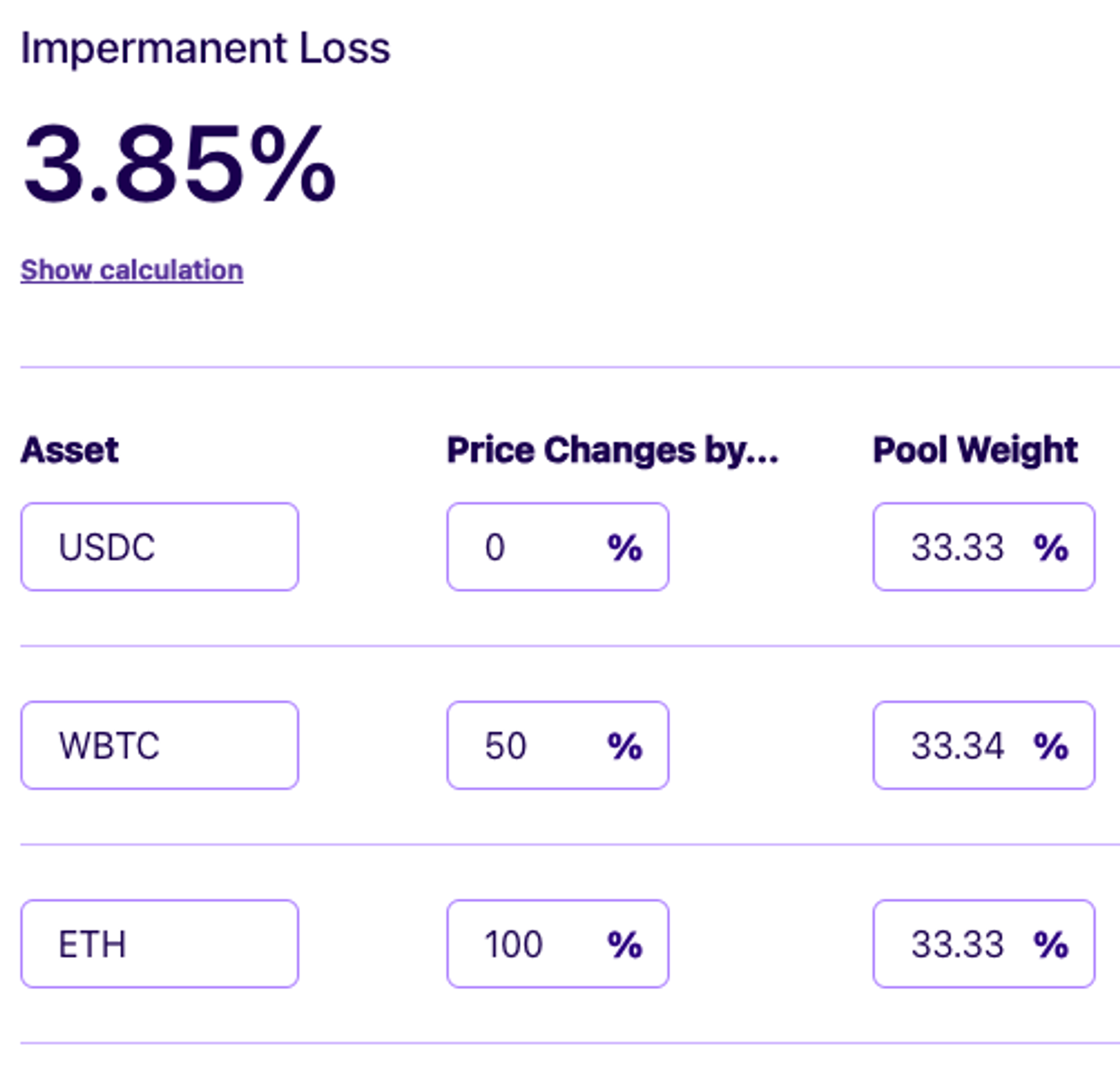

As an investor, your goal is to outperform IL through trading fees and token incentives. This is not impossible as yields on Tricrypto pools often range anywhere between 8-9% on the low end to 20%+ on the high end. Using the IL calculator below, you can see the impact on a Tricrypto portfolio is only ~4% despite BTC’s price increasing by 50% and ETH doubling.

Why choose Tricrypto?

Overall, Tricrypto pools present investors with a compelling option for a balanced, yield-generating crypto portfolio. By depositing liquidity into a Tricrypto pool, you gain:

- Diversified crypto exposure: Spread risks and potential gains across blue-chip crypto assets.

- Passive income potential: Earn yield from trading fees in a high-volume market environment.

- Automated portfolio management: Benefit from the pool's self-rebalancing feature, saving time and effort on asset management.

Start earning 11%+ yield on Tricrypto through Exponential.

In the news

- Standard Chartered expects Ethereum spot ETF approval in May - Read

- Solana-based Jupiter launches massive $700 million airdrop to user wallets - Read

- Report shows demand for Ethereum’s Layer 2 rollups is real as users continue to flock to lower cost chains - Read

- Newly launched Manta Pacific replaces Base as fourth largest Layer 2 rollup - Read