Ethereum is a pillar of the blockchain ecosystem, second only to Bitcoin in terms of market capitalization and influence. While Bitcoin introduced the idea of a digital currency that doesn't need a central authority, Ethereum took it further by creating a platform where not just money, but any kind of application can run without central control. It pioneered the concept of ‘smart contracts’ – digital agreements that live on the blockchain and automatically execute when predefined terms are met.

The innovation of smart contracts represented a fundamental shift in digital agreements. By enabling these contracts to operate independently, Ethereum has unlocked a spectrum of possibilities previously unimagined. Developers are now empowered to build decentralized applications (dApps) that transcend traditional boundaries, ranging anywhere from finance to gaming. This makes Ethereum more than just a blockchain platform – it's a tool that is changing how we use technology and interact with each other, paving the way for a world where many things can be done more freely and securely.

History of Ethereum

Ethereum's history is characterized by constant innovation and a vision that transcended the limitations of its predecessor, Bitcoin. Conceived by Vitalik Buterin, Ethereum was envisioned as a platform not just for financial transactions but for facilitating complex, programmable interactions. From its inception, Ethereum adopted the concept of 'gas'—a common feature in blockchain technology representing the computational resources required for transactions and smart contract executions. In Ethereum's case, these gas fees are paid in its native currency, ETH (or Ether), to strategically drive organic demand for the asset.

This foundational approach to gas and transaction processing set the stage for significant advancements in Ethereum's technology. One of the major steps in Ethereum's evolution was the introduction of EIP-1559. This was an upgrade that changed how transaction fees are handled on the Ethereum network. Before this change, users often faced unpredictable and sometimes high fees due to a bidding system for processing transactions. EIP-1559 simplified this by setting a standard 'base fee' for transactions, which goes up or down depending on how busy the network is. This made fees more predictable for users. Additionally, part of these fees is destroyed or 'burned', which could help reduce the total amount of ETH over time, potentially making it more valuable.

The biggest shift for Ethereum came with the move to Ethereum 2.0 on September 15, 2022, known as "The Merge." This change moved Ethereum from a system that required a lot of energy to one that is far more energy-efficient and can handle more transactions. This wasn't just a technical upgrade; it was a complete overhaul of how Ethereum works, making it faster and more environmentally friendly. This step is crucial for making blockchain technology more sustainable for the planet.

Investment thesis for Ether

Ethereum's ever-evolving landscape has directly influenced its tokenomics (short for ‘token economics’), creating a robust link between network activity and token valuation. Tokenomics describes the relationship between network design and token value; it helps to explain how a network or application’s design can create economic value for token holders. While in most cases, the success between the two is correlated, this is not always the case. Ethereum has optimized to have a stronger linkage between the two and thus should see several tailwinds as network activity continues to increase. Here are some of the reasons to consider Ethereum as a cornerstone of your investment portfolio:

‘Ultrasound’ money

The transformation of Ethereum into a PoS model, coupled with the adoption of EIP-1559, has set in motion a deflationary mechanism wherein a portion of transaction fees—specifically the base fees—are permanently 'burned.' This means that these fees, which previously were awarded in full to miners, are now retired from circulation. Since ‘the merge’, over 1.44 million ETH have been burned, outstripping the approximately 1.07 million ETH issued, resulting in an annual deflation rate of -0.21%. This is a stark contrast to the U.S. inflation rate, which peaked at 8% in March 2023. Notably, this deflationary trend in Ethereum has mostly unfolded during a bear market, a period characterized by substantially lower on-chain activity.

The introduction of this deflationary feature has led enthusiasts to coin the term 'ultrasound money' for Ethereum. While Bitcoin is praised as 'sound money' due to its capped supply, Ethereum is often referred to as 'ultrasound money' because of its decreasing supply over time. Unlike traditional fiat currencies, which are susceptible to devaluation through inflation as a result of unrestricted printing, Ethereum's burning mechanism adds deflationary pressure to the supply. Over time, this could potentially increase the value of each ETH due to reduced supply, assuming demand remains constant or increases. For investors, this aspect of Ethereum presents an appealing store of value, similar to the appeal of Bitcoin but with the added functionality and utility that Ethereum’s platform provides.

Yield-bearing asset

Ethereum, as a PoS network, offers investors an opportunity to earn passive income through staking. By holding and staking ETH, investors not only help secure the Ethereum network but also earn rewards in the form of additional ETH, with an average annual yield of around 4%. This yield is noteworthy in the context of the cryptocurrency market, where ETH staking represents a stable return option akin to a 'risk-free rate'.

On top of that, Ethereum's bustling decentralized finance (DeFi) world offers even more ways to generate yield. These range from decentralized lending and liquidity provision to innovative financial instruments, expanding the scope for both passive and active investors. This dual aspect of stable returns from staking and diverse opportunities in DeFi makes Ethereum a compelling option for yield-seeking investors.

Scalability and adoption

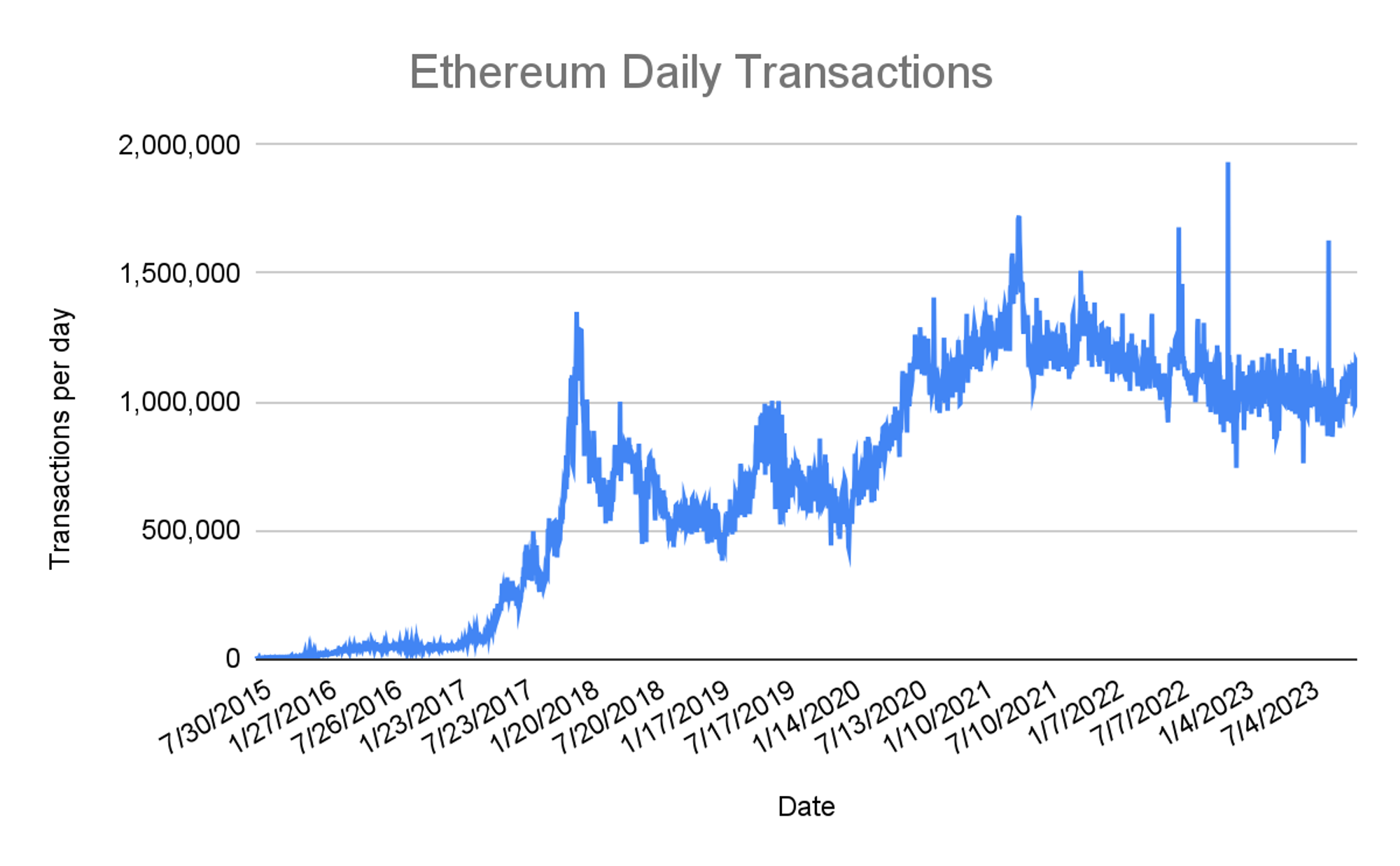

Ethereum’s evolution in scalability, particularly with the implementation of Layer 2 solutions, is fundamental to its growing allure as an investment. These technological advancements are instrumental in addressing the network's historical bottlenecks: high transaction fees and network congestion. In 2023, Ethereum has impressively processed an average of 1.04 million transactions per day, marking a 27-fold increase since 2016. This surge in transaction volume not only demonstrates Ethereum's enhanced throughput but also reflects its expanding utility and user base.

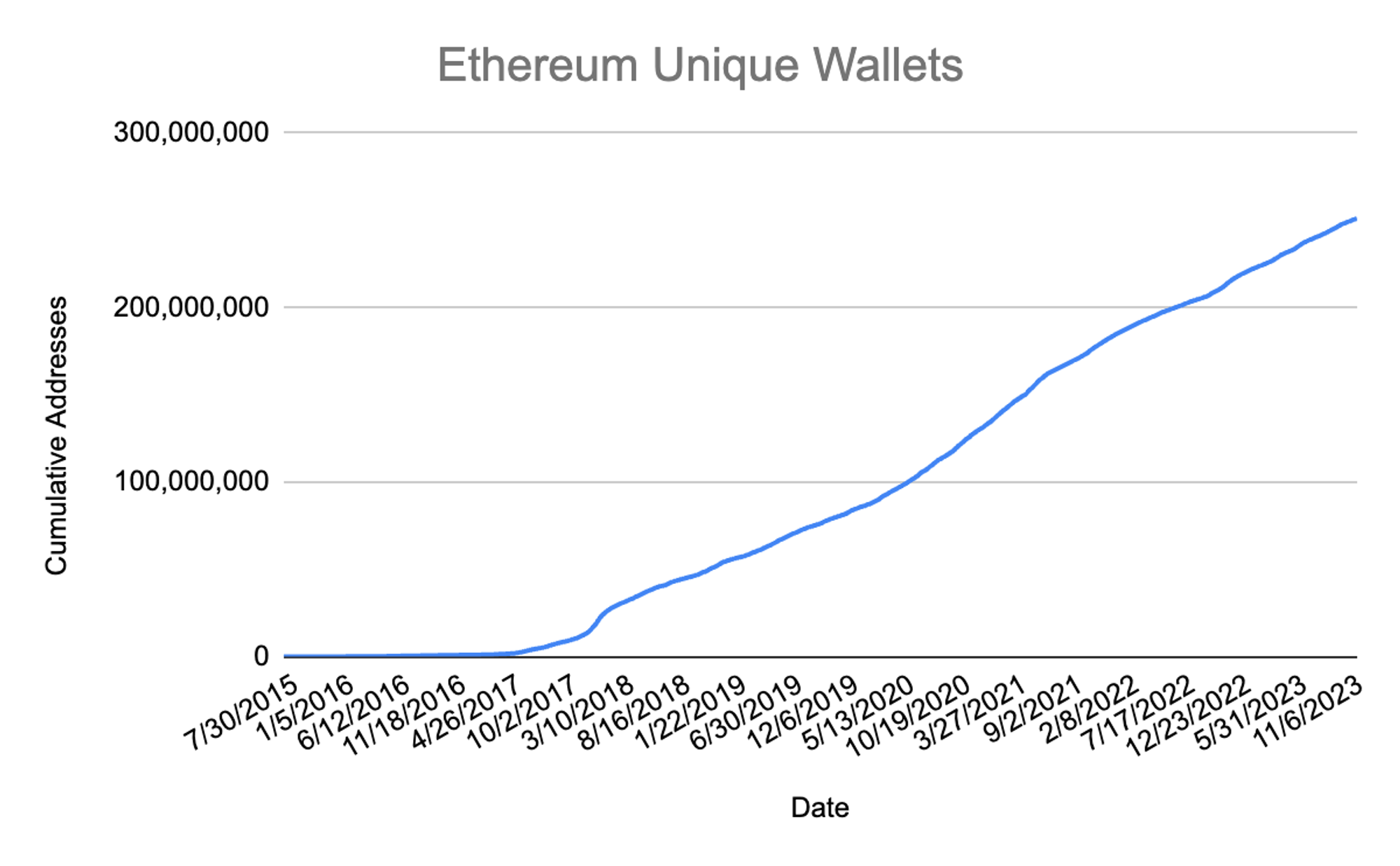

The expansion of Ethereum's user base is further evidenced by the over 32 million unique wallets created in 2023, demonstrating a broadening appeal and accessibility. This surge in active users is a powerful indicator of Ethereum's growing ecosystem. As Ethereum continues to evolve and adapt, its increased network efficiency and widespread application in various domains, like non-fungible tokens (NFTs) and DeFi, solidify its position as a leading force in the blockchain ecosystem.

Diversification benefits

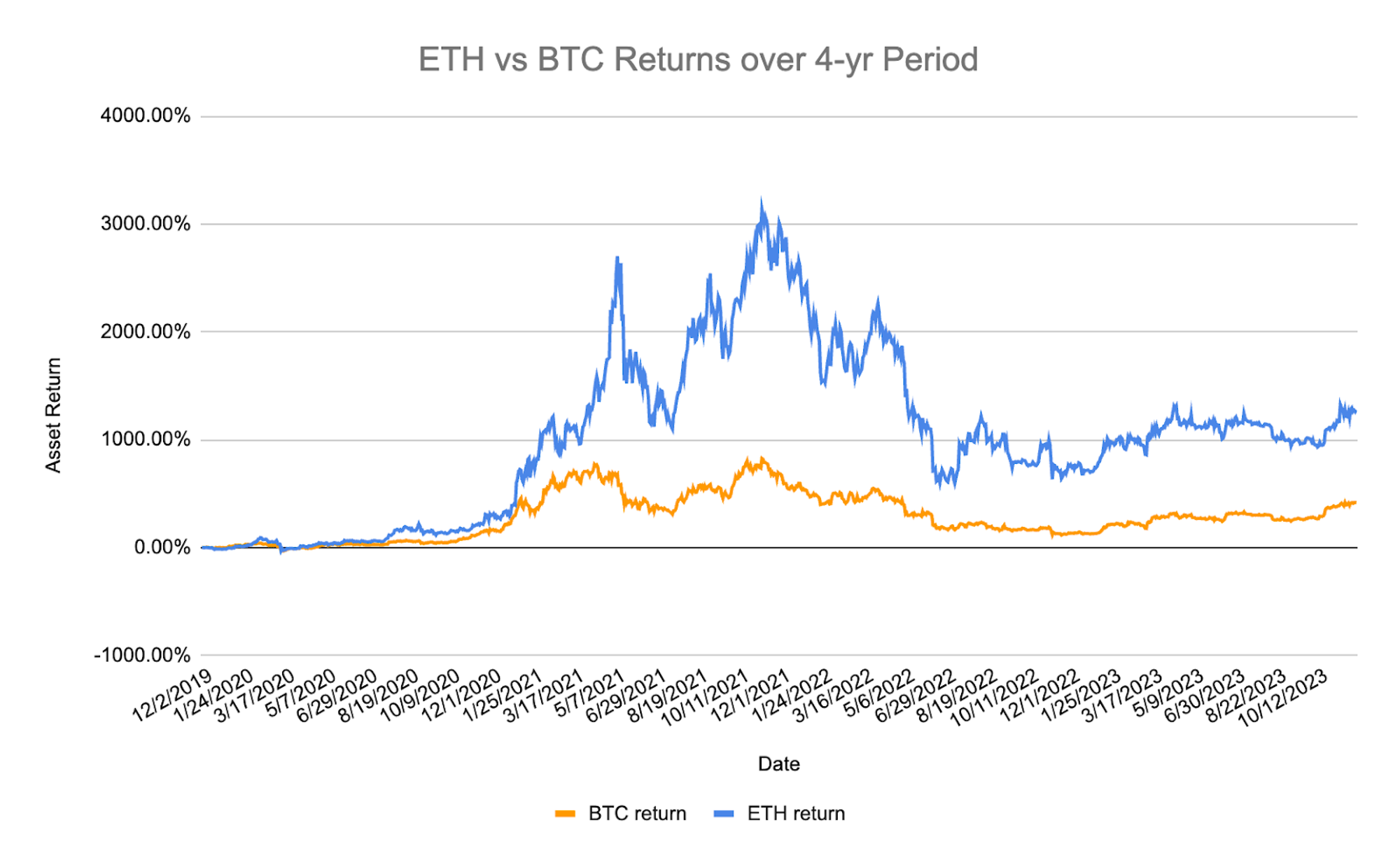

Investing in Ethereum can significantly enhance the diversification of an investment portfolio. Cryptocurrencies have historically exhibited a relatively low correlation with traditional asset classes like stocks and bonds. This characteristic means they can offer unique diversification benefits. Ethereum is especially interesting because it's used for so many things - it's a major platform for decentralized applications (dApps), digital art (NFTs), and decentralized finance (DeFi). This sets Ethereum apart from other cryptocurrencies, including Bitcoin. In fact, Ethereum has seen an average annual return of 96%, even greater than Bitcoin’s 78% growth over the same period. This performance, coupled with its broad spectrum of use cases, makes Ethereum an appealing option for investors looking to broaden their portfolios beyond traditional markets.

How to buy Ether

Buying and using ETH has become increasingly accessible, but it still requires some basic knowledge of cryptocurrency platforms and wallets. While direct investment in ETH might not be a feature of Exponential, understanding how to buy and use ETH can provide valuable context for the services we offer.

A brief guide to buying Ether

To buy ETH, one typically selects a cryptocurrency exchange like Coinbase, Binance, Kraken, or Gemini, creates an account, deposits funds, and purchases ETH. While this is a standard route for direct Ethereum investment, Exponential offers a more nuanced approach.

Exponential’s unique approach

At Exponential, we focus on integrating the potential of Ethereum into the broader landscape of DeFi. Although we don’t facilitate direct purchase of ETH, we curate the best DeFi pools that involve ETH or ETH derivative assets and make it easy to invest in them safely and securely. This strategy allows our users not only to gain exposure to ETH’s market movements but also to earn yield on top of any ETH growth, amplifying their investment over time.

The advantage of DeFi pools

Investing in DeFi pools through Exponential means you’re participating in a novel financial ecosystem, where ETH acts as more than just a digital asset. It’s a gateway to earning yield through advanced DeFi applications, leveraging Ethereum's technology for more than just asset appreciation.

Earning yield on Ether

By choosing Exponential, you benefit from the long-term price movements of ETH while simultaneously earning yield through DeFi applications. This dual benefit allows for a sophisticated investment approach, aligning with both growth and income objectives.

Getting started with Exponential

To begin exploring the dynamic world of Ethereum and DeFi with Exponential, we invite you to join our platform. We offer a streamlined process to engage with DeFi pools, providing you with the necessary tools and guidance to help you get started in your DeFi investing journey.

Future of Ethereum

Ethereum's status as a leading blockchain platform is undisputed, with its advanced programmability allowing developers to create dApps far beyond Bitcoin’s capabilities. This technical superiority has led to some of the most significant and active applications being built on Ethereum. This edge has solidified ETH’s status as the second-largest cryptocurrency by market cap. The dynamic between network activity and token value has been positively correlated thus far and will continue to evolve with further network upgrades and the advent of Layer 2 scaling solutions.

As Ethereum continues to evolve with new advancements, it looks set for even more growth and innovation. Its ability to adapt and the continuous improvements in areas like decentralized finance (DeFi) play a key role in determining its path and influencing the wider world of digital assets. This makes Ethereum a central point of attention for developers, investors, and users within the cryptocurrency community.

FAQ

What is ETH?

ETH, or Ether, is the native currency of Ethereum, a prominent blockchain platform. It holds the distinction of being the second-largest cryptocurrency by market capitalization, trailing only behind Bitcoin.

What is the total supply of Ethereum?

Ethereum's total supply is not capped, distinguishing it from Bitcoin's fixed supply of 21 million. However, Ethereum's transition to a proof-of-stake model and the implementation of EIP-1559 (where a portion of transaction fees are burned) are designed to potentially make Ethereum's supply net deflationary over time.

Can Ethereum be considered money?

Ethereum shares several characteristics with traditional money, such as being a medium of exchange, a store of value, and a unit of account. However, it operates on a decentralized, digital platform, which sets it apart from conventional fiat currencies.

What are Ethereum's key features?

Ethereum is known for its ability to support smart contracts and decentralized applications (dApps). Smart contracts are self-executing contracts with the terms directly written into code. This feature enables a wide range of applications, including decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

How does Ethereum differ from Bitcoin?

While both Ethereum and Bitcoin are both blockchain-based cryptocurrencies, they serve different purposes. Bitcoin was created primarily as a digital alternative to traditional currencies, thus functioning mainly as a store of value and medium of exchange. Ethereum, on the other hand, extends beyond being a digital currency. It is a decentralized platform that enables the creation and operation of smart contracts and dApps.

What is Ethereum 2.0?

Ethereum 2.0, also known as Eth2, is an upgrade to the Ethereum blockchain. This upgrade aimed to improve the network's scalability, security, and sustainability. It involved transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, which significantly reduces energy consumption and allows for faster transaction processing.

Who created Ethereum?

Ethereum was proposed in 2013 by programmer Vitalik Buterin and subsequently developed by Buterin, Gavin Wood, and other co-founders. Its development was crowdfunded in 2014, and the network went live on July 30, 2015.

How does Ethereum work?

Ethereum operates on a decentralized network of computers, or nodes. These nodes validate and record transactions on Ethereum’s blockchain, a secure and transparent digital ledger. Following its recent upgrade to Ethereum 2.0, the network now uses a proof-of-stake mechanism, where validators stake their ETH to secure the network and are rewarded for processing transactions and creating new blocks.

Where does new Ethereum come from?

New Ethereum is minted through the network's issuance process. Validators who stake their ETH are rewarded with new Ethereum for their role in maintaining and securing the network. This issuance is an incentive for validators to operate honestly and efficiently.

Can Ethereum scale to meet growing demand?

Scaling has been a challenge for Ethereum, especially as the network has grown in popularity. The Ethereum 2.0 upgrade was a significant step towards improving its scalability along with future upgrades like proto-danksharding. These upgrades will enable the network to process more transactions per second and accommodate more users and applications.

Is now a good time to invest in Ethereum?

Investing in Ethereum, like any cryptocurrency, carries inherent risks and opportunities. Ethereum has shown significant growth since its launch, becoming a cornerstone of the crypto economy. However, potential investors must remember that the cryptocurrency market is highly volatile. Past performance is not a reliable indicator of future results. Individuals should conduct thorough research, consider their investment goals and risk tolerance, and possibly consult with a financial advisor before investing in Ethereum.