Hint: It’s much more than just a cryptocurrency

Imagine a world where money isn’t controlled by banks or governments but by a network of computers spread across the globe. Welcome to the world of Bitcoin, a groundbreaking digital currency that was created for this very reason – to separate money from the state. Emerging in the wake of the 2008 financial crisis, Bitcoin has sparked a financial revolution that has captivated investors worldwide. From being worth mere cents to soaring to astronomical highs, Bitcoin has not only challenged our traditional notions of money but has also emerged as a new asset class, sparking both controversy and adoration amongst investors.

The evolution of Bitcoin

Bitcoin’s journey from an obscure digital token to a valuable asset began humbly. In 2008, in the midst of a global financial meltdown, a person (or group) under the pseudonym Satoshi Nakamoto introduced the Bitcoin whitepaper. In the paper, Satoshi proposed the idea for a new digital currency; it was a revolutionary idea at the time – a decentralized, peer-to-peer electronic cash system independent of traditional banking institutions.

Bitcoin was more a concept than a commodity in these early days, with values amounting to fractions of a cent. In 2010, a programmer made the first known purchase with Bitcoin, buying two pizzas for 10,000 Bitcoins – a transaction now valued in millions and celebrated in the crypto world as "Bitcoin Pizza Day." This was a pivotal moment, marking the first recorded purchase of a physical good using Bitcoin.

Yet, Bitcoin’s path has been anything but smooth. By 2013, Bitcoin had astonishingly surpassed $1,000, drawing the world’s attention, but then rapidly fell, showcasing its volatile nature. The years that followed were marked by even more turbulence. In 2017, the world again watched in awe as Bitcoin skyrocketed to nearly $20,000, only to plummet back to around $3,000 the following year, testing the resolve and patience of investors.

Bitcoin’s most staggering peak came in 2021, when it soared to nearly $70,000. This unprecedented rise was fueled by a confluence of factors – increased institutional investment, broader mainstream acceptance, and a burgeoning global interest in digital currencies amidst the uncertainties of a global pandemic. This period marked Bitcoin's transition from a niche digital asset to a mainstream financial phenomenon.

As of today, Bitcoin has retracted from its all-time highs, but it still stands resilient, with a price hovering around $40,000. This price point is not just a number; it represents the growing maturation of the cryptocurrency market and Bitcoin's established status as the forerunner of digital assets.

Investment thesis for Bitcoin

Bitcoin stands as a paradigm-shifting asset that has fundamentally altered our perception of what a currency can be. At its core, Bitcoin is decentralized, operating on a global scale without the oversight of any central authority. This independence from traditional financial systems is a response to a growing demand for financial autonomy and privacy. In a world where digital transactions are becoming the norm, Bitcoin represents a shift towards a more open and accessible financial system. Here’s a few reasons investors are drawn to it.

Historical outperformance

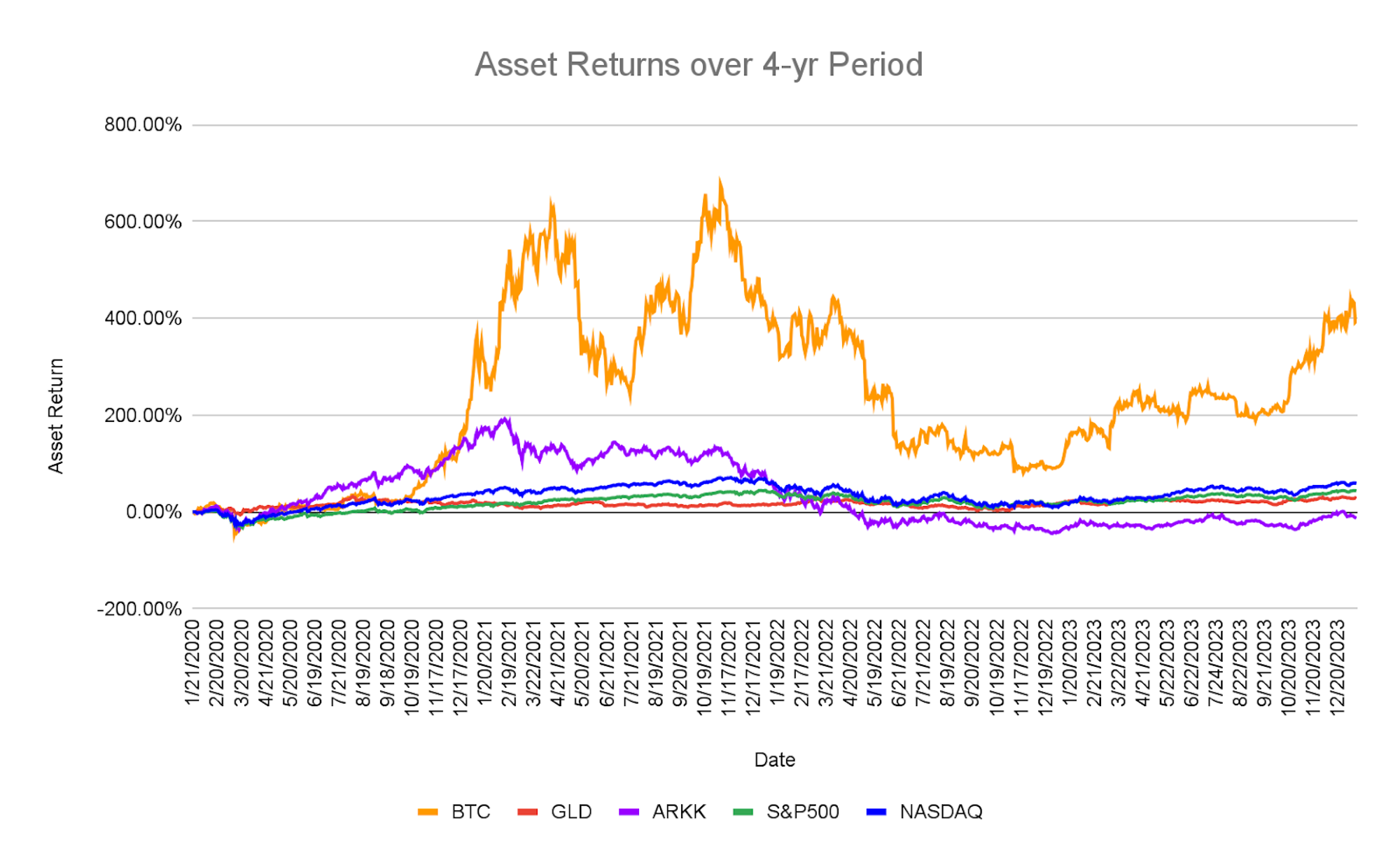

When we look at Bitcoin's performance as an investment, its track record is impressive, especially in comparison to traditional assets like stocks and gold. Despite its volatility, Bitcoin has experienced significant growth over the years, outperforming many conventional investment vehicles. For example, the NASDAQ index, a broad-based market index that includes over 3,700 stocks, has grown by 66% over the past four years. Gold, often viewed as a safe-haven asset, has only returned 28% over the same period. In comparison, Bitcoin’s four-year growth stands at a staggering 400%! This robust performance, marked by rapid value appreciation, has drawn the attention of both retail and institutional investors looking for high-growth opportunities.

Store of value

One of the most compelling aspects of Bitcoin is its scarcity. Unlike fiat currencies, which central banks can print indefinitely, the supply of Bitcoin is capped at 21 million. This finite supply mirrors the principles of precious metals like gold, earning Bitcoin the moniker of 'digital gold'. This scarcity is a key factor in Bitcoin's value proposition. As demand increases against a limited supply, Bitcoin's value has the potential to rise, making it an attractive asset for long-term investment.

Portfolio diversification

In times of economic uncertainty and inflation, Bitcoin has increasingly been viewed as a hedge. Its decentralized nature and detachment from government policies make it less susceptible to inflationary pressures that affect traditional currencies. Moreover, during periods of market volatility, Bitcoin has shown an uncanny resilience, further cementing its position as a viable diversification option in investment portfolios.

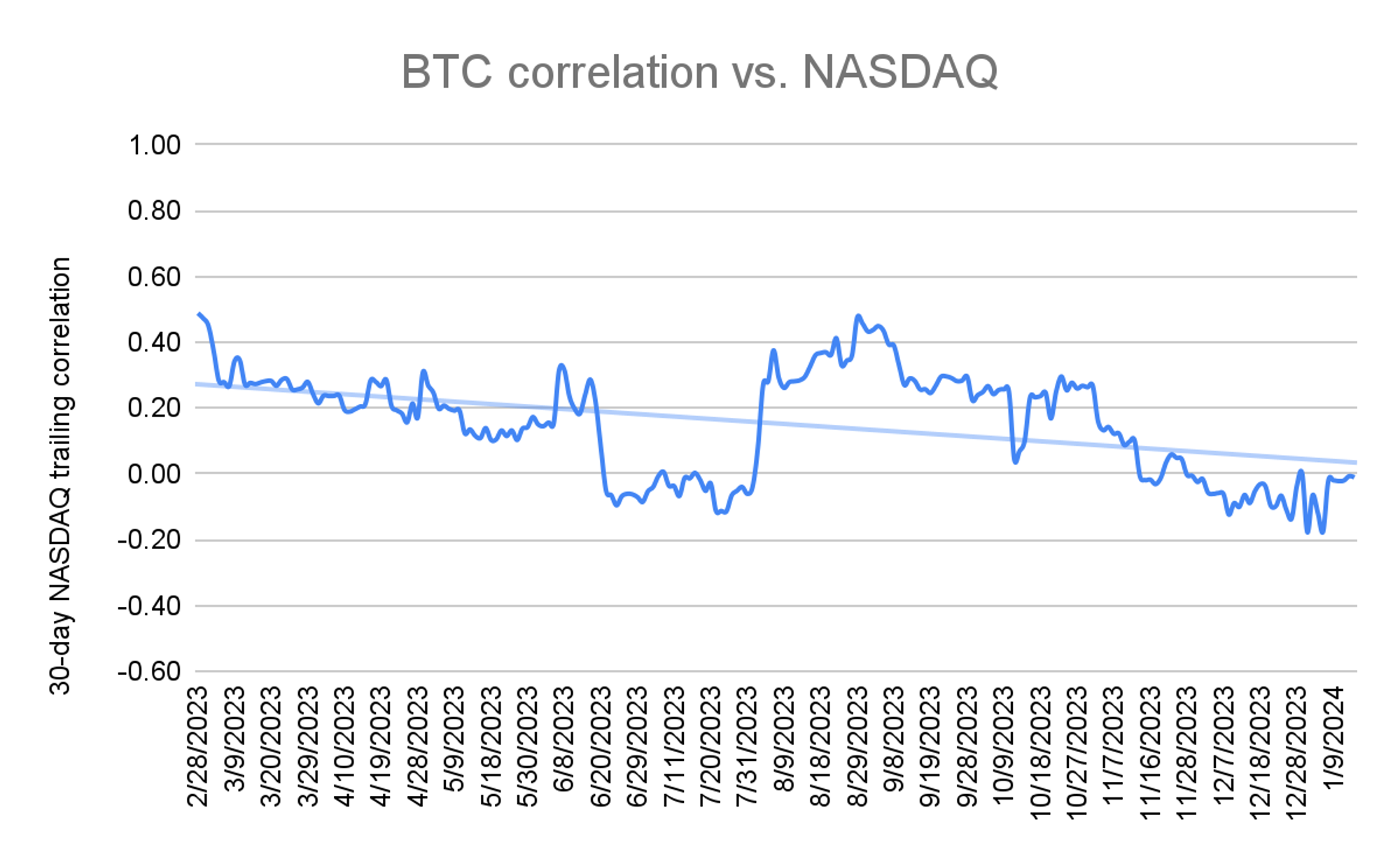

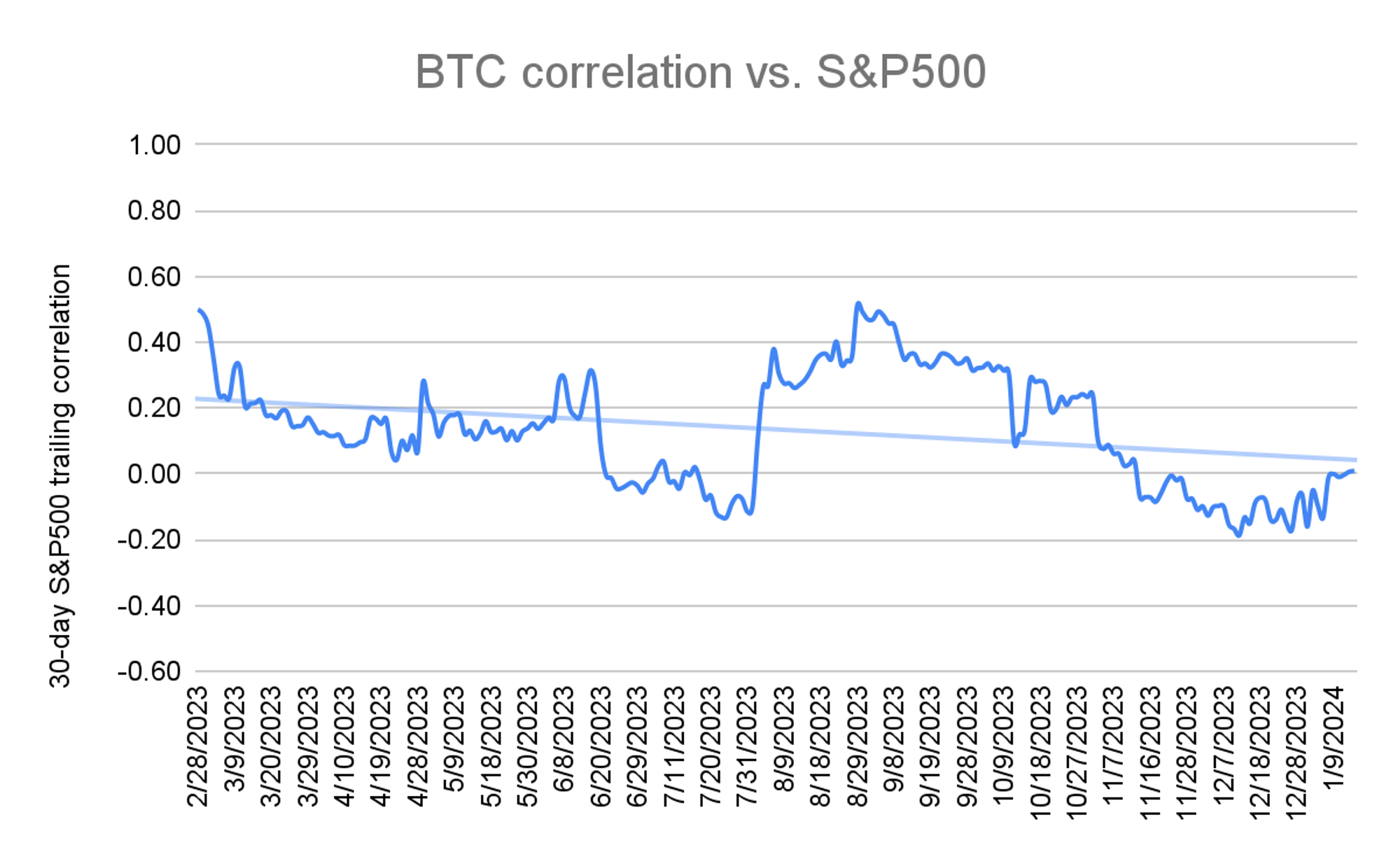

Recent trends have also shown a decreasing correlation between Bitcoin and traditional market indices like the NASDAQ and S&P 500. Over the past year, Bitcoin's correlation to these indices has reduced from ~0.5x to near zero correlation. This decline in correlation suggests that Bitcoin can offer diversification benefits, potentially reducing overall portfolio risk. The diversification potential of Bitcoin has even been recognized by notable figures in the investment world. For instance, Paul Tudor Jones, a renowned hedge fund manager, has advocated for allocating a small portion of an investment portfolio to Bitcoin. He suggests a 1-2% allocation, especially in the current macroeconomic backdrop characterized by concerns of recession and geopolitical instability.

Upcoming catalysts

Looking ahead, there are two significant catalysts on the horizon that could notably influence Bitcoin's trajectory in the near to medium term:

Institutional and retail adoption

A monumental shift is underway with the recent approval of Bitcoin spot exchange-traded funds (ETFs) in the U.S. This development is more than just a regulatory milestone; it paves the way for a surge in institutional adoption. With these ETFs, a broader range of investors, including those previously hesitant about direct cryptocurrency engagement, can now access Bitcoin within a regulated, familiar investment framework. The introduction of spot ETFs, which necessitates holding actual Bitcoin, is expected to catalyze substantial capital inflows. This steady institutional embrace throughout 2024 and beyond could bolster Bitcoin's standing as a mainstream investment asset, attracting both seasoned and new investors.

Next halving event

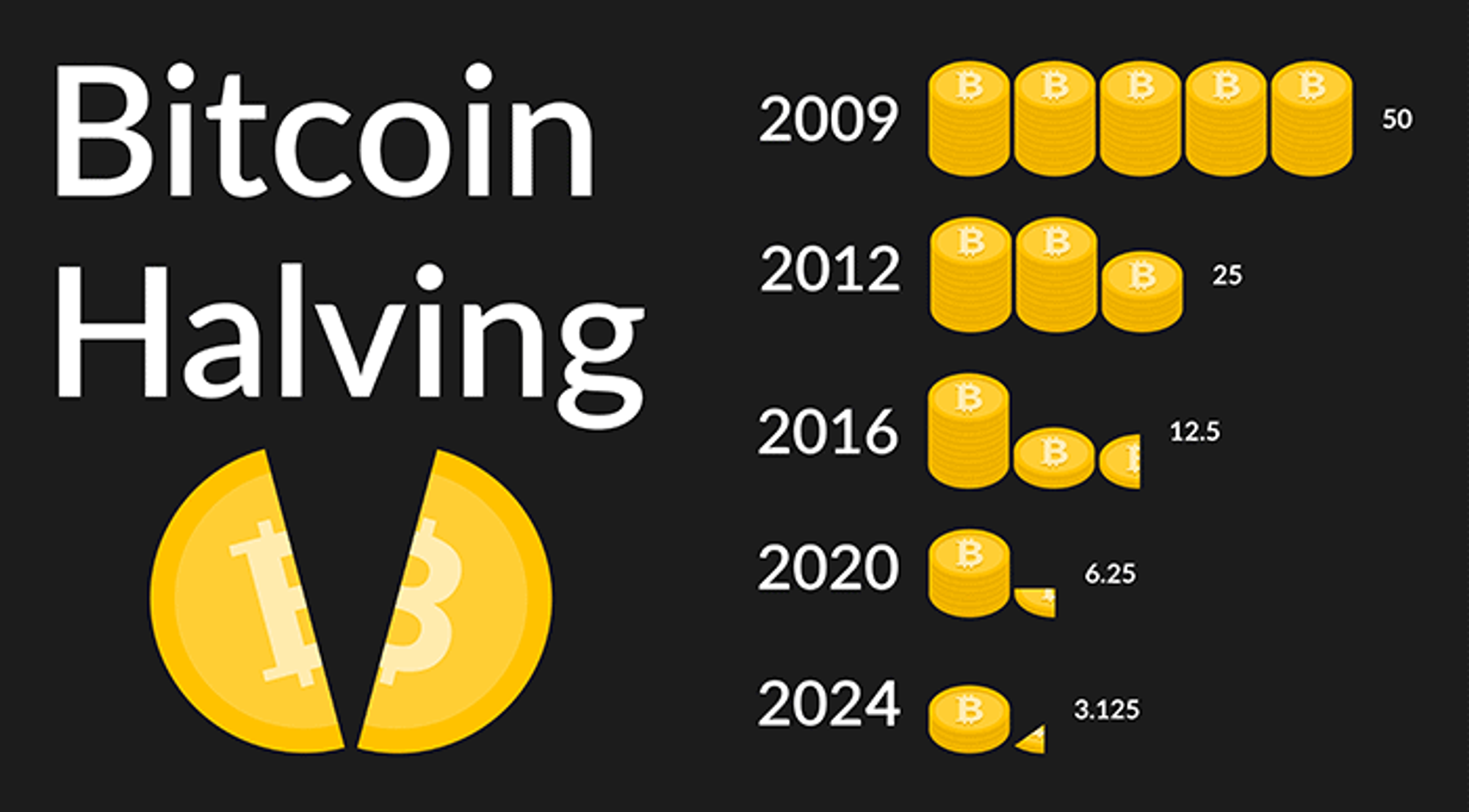

Another catalyst is tied to one of Bitcoin’s unique features – the halving event, which occurs approximately every four years, where the reward for mining new blocks is halved. This effectively reduces the rate at which new Bitcoins are created, a mechanism that was designed to control Bitcoin's supply and mimic the scarcity-driven appreciation similar to precious metals. Historically, these events have had a significant impact on Bitcoin’s price, typically triggering a bullish period. The next halving, anticipated in April 2024, is already generating buzz, as historical patterns suggest a potential increase in Bitcoin's value, making it an event closely watched by investors.

How to buy Bitcoin

Buying and using Bitcoin has become increasingly accessible, but it still requires some basic knowledge of cryptocurrency platforms and wallets. While direct investment in Bitcoin might not be a feature of Exponential, understanding how to buy and use Bitcoin can provide valuable context for the services we offer.

A brief guide to buying Bitcoin

Purchasing Bitcoin typically involves selecting a reputable cryptocurrency exchange (like Coinbase, Binance, Kraken, or Gemini), creating an account, depositing funds, and then buying Bitcoin. This conventional method is straightforward for those looking to hold Bitcoin directly.

Exponential’s unique approach

At Exponential, our approach to Bitcoin differs. We integrate Bitcoin’s investment potential into the DeFi space, not through direct Bitcoin holdings but through BTC derivative assets. These assets, often in the form of wrapped Bitcoin (WBTC), allow Bitcoin to be used on Ethereum-based DeFi platforms. This approach enables our users to gain exposure to Bitcoin’s market movements and to earn additional yield through DeFi applications.

The advantage of DeFi pools

Investing in DeFi pools through Exponential means you’re participating in a novel financial ecosystem, where Bitcoin acts as more than just a digital asset. It’s a gateway to earning yield through advanced DeFi applications, leveraging Ethereum's technology for more than just asset appreciation.

Earning yield on Ethereum-based assets

By joining Exponential, you benefit from Bitcoin's price movements indirectly through BTC derivative assets like WBTC. At the same time, you earn yields via DeFi applications. This strategy offers a sophisticated investment model, aligning with both capital growth and passive income goals.

Getting started with Exponential

To embark on your journey with Bitcoin in the DeFi world through Exponential, we welcome you to our platform. We provide a straightforward pathway to engage with Bitcoin-based DeFi pools, complete with the tools and guidance necessary for your DeFi investment journey.

Future of Bitcoin

As Bitcoin continues to evolve, its future remains a topic of intense speculation and interest. Investing in Bitcoin comes with significant risks, primarily due to its volatility and the evolving regulatory landscape. The environmental impact of Bitcoin mining, which consumes substantial energy, is also a concern for many. Potential investors should be aware of these factors and consider the security risks associated with digital currencies.

Major catalysts, like the approval of spot Bitcoin ETFs and the anticipated halving event in April 2024, could further influence its adoption and value. However, the journey of Bitcoin is as much about technological innovation as it is about financial evolution, reflecting a growing desire for a more open and accessible financial system.

FAQ

What is BTC?

BTC is the ticker symbol or abbreviation for Bitcoin, the first and most well-known cryptocurrency.

What is the total supply of Bitcoin?

The total supply of Bitcoin is capped at 21 million coins. This limited supply is one of the factors that underpin its value proposition.

Is Bitcoin money?

Bitcoin exhibits characteristics of money, such as being a medium of exchange, a store of value, and a unit of account. However, it differs from traditional fiat currencies in that it is entirely digital and operates on a decentralized network.

Is Bitcoin dead?

Despite numerous price fluctuations and market cycles, Bitcoin is far from dead. It continues to be a leading cryptocurrency with a robust network, strong user base, and growing acceptance as an investment asset and payment method. Its decentralized nature and limited supply also continue to attract investors, underscoring its resilience and potential for long-term viability.

Who created Bitcoin?

Bitcoin was created by an individual or group using the pseudonym ‘Satoshi Nakamoto.’ The true identity of Satoshi Nakamoto remains unknown.

Who owns the most Bitcoin?

The individual or group known as Satoshi Nakamoto, who created Bitcoin, is believed to have mined around 1.1 million bitcoins in the early days of the network. If these coins are still owned by Satoshi, this would make them one of the largest holders of Bitcoin. However, these coins have not moved from their original wallets, leading to much speculation about their status and the intentions of Bitcoin's enigmatic creator.

What is a satoshi?

A satoshi is the smallest unit of the Bitcoin cryptocurrency, named after Bitcoin's pseudonymous creator, Satoshi Nakamoto. It represents one hundred millionth of a single Bitcoin (0.00000001 BTC), making it a critical element for microtransactions using Bitcoin. The satoshi enables the Bitcoin network to facilitate payments for very small amounts, providing flexibility and precision in transactions.

How many satoshis are there in a Bitcoin?

There are 100,000,000 satoshis in a single Bitcoin. This subdivision allows for small transactions and accommodates the deflationary nature of Bitcoin, where the value of a single coin can be quite high relative to fiat currencies. As the value of Bitcoin increases, the utility of the satoshi unit becomes more prominent, ensuring that users can continue to transact with fractions of Bitcoin efficiently.

How does Bitcoin work?

Bitcoin operates on a decentralized network of computers. Transactions are verified and recorded on a digital ledger called the blockchain. This process is carried out by nodes or 'miners' who use powerful computers to solve complex mathematical problems. Successful miners are rewarded with new Bitcoin, incentivizing them to maintain and secure the network.

Where does new Bitcoin come from?

New Bitcoin is created through a process called 'mining.' Miners around the world compete to solve complex mathematical problems, and the first to solve it gets to add a new block of transactions to the blockchain. As a reward, they receive newly minted Bitcoin. This process introduces new Bitcoin into the system in a controlled and predictable manner.

When is the next Bitcoin halving?

The next Bitcoin halving is expected to occur in April 2024. During this event, the reward for mining a new block will halve from 6.25 to 3.125 Bitcoin. Halving events occur approximately every four years and are a key feature of Bitcoin's economic model.

Is now a good time to invest in Bitcoin?

Investing in Bitcoin, like any investment, carries risk. Historically, Bitcoin has proven to be a lucrative long-term investment for many, showing substantial growth since its inception. For instance, despite its volatility, Bitcoin has seen remarkable appreciation in value over the past decade, outperforming many traditional investment assets. In addition, historical data shows that Bitcoin's price has often increased following halving events; however, it's important to remember that past performance is not indicative of future results. The cryptocurrency market is known for its high volatility. Potential investors should conduct thorough research and consider their risk tolerance before making an investment decision.