The DeFi winter is thawing and ready for a hot bull summer

Summer gains are made with winter research, so let’s do a deep dive into the current state of DeFi.

The latest indicators signal not just growth but a transformative shift. The surging interest in DeFi yields now aligns with a market maturing towards rationality, efficiency, and heightened risk awareness.

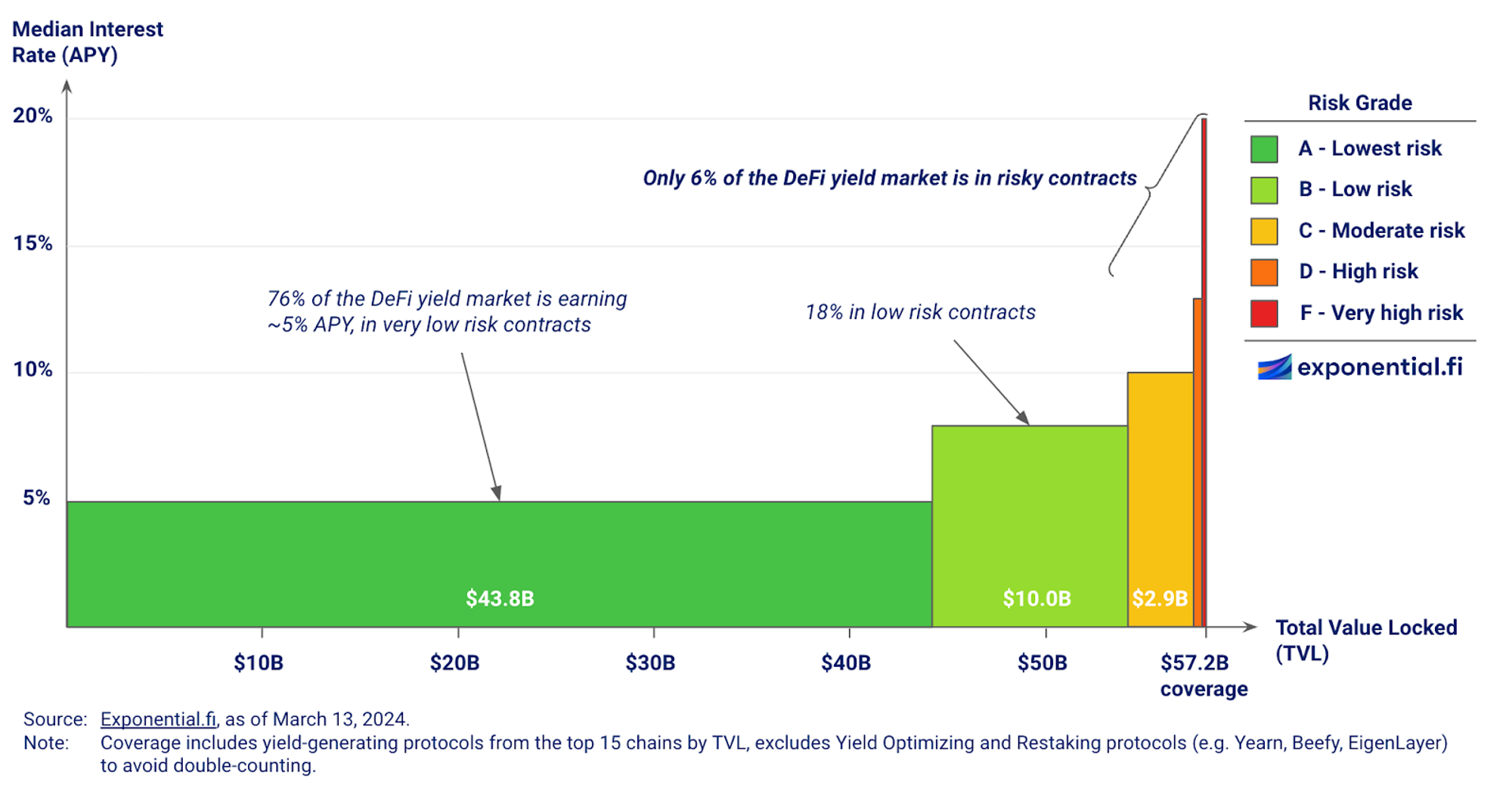

Degens are rational: Prioritizing safety over high yields

Our insights reveal a strong preference by investors for security over the pursuit of high yields. An overwhelming 75% of DeFi total value locked (TVL) is now in pools offering a modest 0-5% APY. This conservative allocation, particularly evident in Ethereum staking pools, signifies a profound change in investor behavior. The trend towards established protocols like Lido marks a significant shift from mere yield chasing to a preference for predictability and safety.

At Exponential, our dedication to securing your investments is reflected in our extensive risk framework. We thoroughly assess the risks associated with DeFi pools by evaluating numerous on-chain and off-chain factors. This approach, alongside a growing trend towards investing in pools with high security and risk management standards (rated A or B), illustrates a maturing DeFi market that prioritizes a stable and secure ecosystem.

A renewed optimism in DeFi

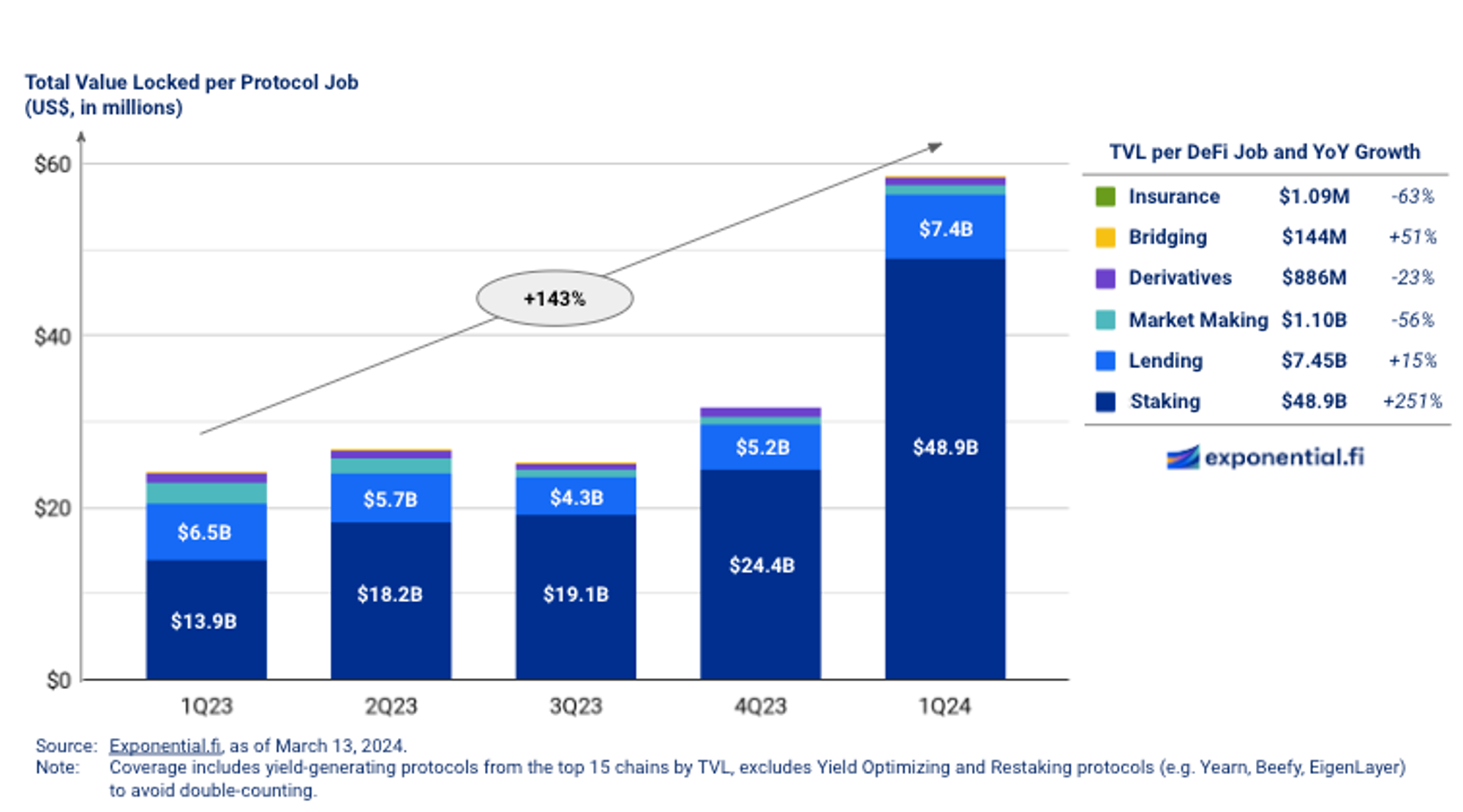

The TVL in yield-generating DeFi protocols has seen a steady climb from $26.5 billion in the third quarter of 2023 to $59.7 billion in the first quarter of 2024. This resurgence signals a return of confidence and liquidity to the DeFi markets.

The landscape of DeFi jobs is also evolving. At Exponential, we classify protocols based on the ‘job’ they perform to generate yield. While there's a significant shift towards low-risk endeavors like staking and secured lending, interest in sectors like insurance and derivatives has waned. This transition highlights the challenges of fitting certain financial activities into the DeFi framework due to inherent asymmetries in information between liquidity providers and yield seekers.

Staking (and Restaking): The vanguard of DeFi’s growth

Staking allows the validation of blockchain transactions and securing the network, and liquidity providers earn gas fees from the transactions inscribed on the blockchain.

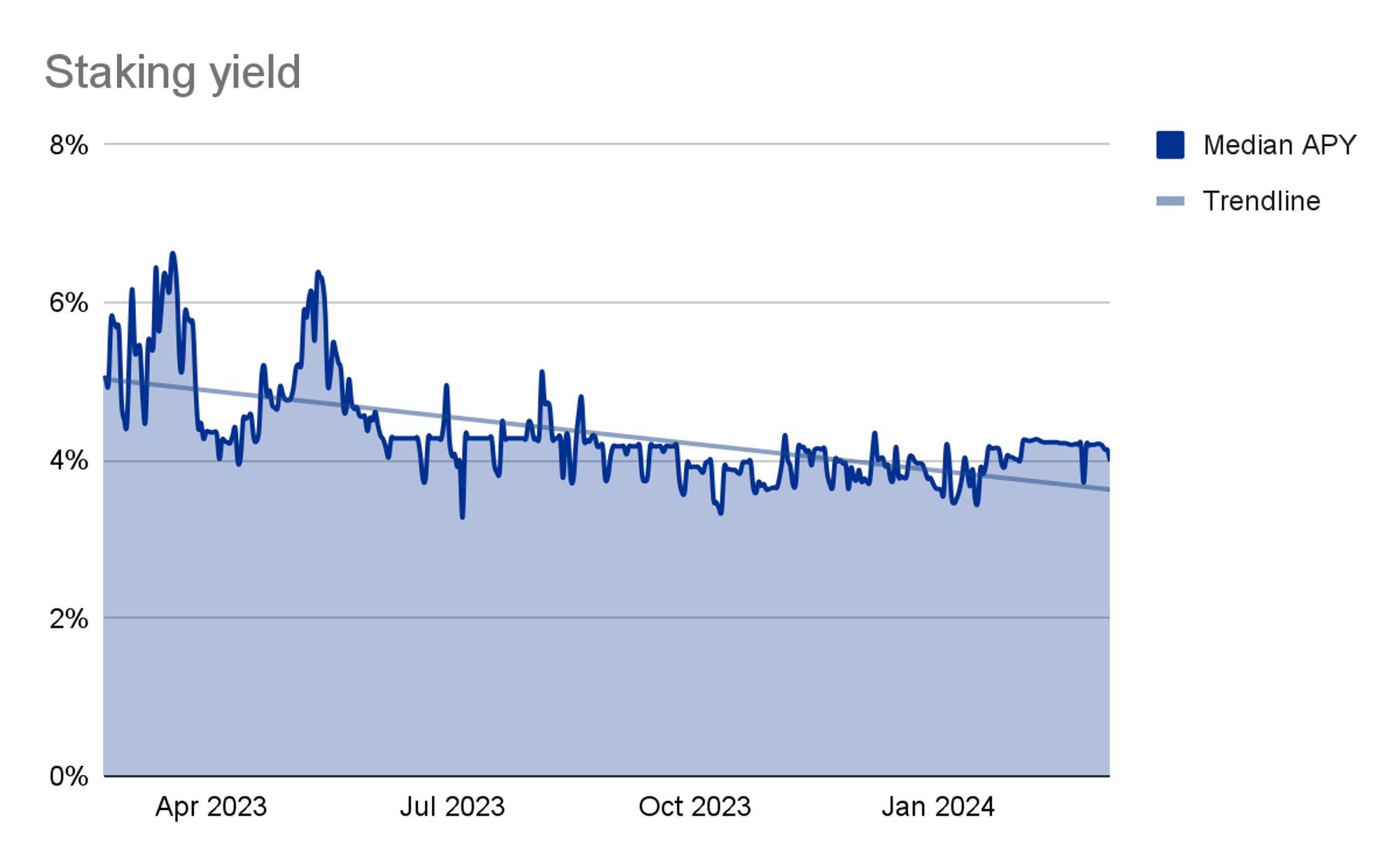

Staking stands at the forefront of DeFi's explosive growth, catalyzed by Ethereum's shift to a Proof-of-Stake model. The amount of staked Ether has more than doubled since the Merge, solidifying staking as a cornerstone of DeFi's value proposition. Despite the natural decline in yields due to increased participation, staking now comprises over 80% of DeFi's TVL.

The emergence of restaking through EigenLayer has further boosted demand for Ethereum staking. Restaking allows stakers to secure additional networks with their staked Ether, offering higher yields but with increased risk. EigenLayer's remarkable growth, with its TVL soaring past $12 billion, positions restaking as a major 2024 trend, promising higher yields and the opportunity for multiple airdrops.

The Lending renaissance: Fueled by leverage

Lending allows borrowers to get a loan against mortgaged digital assets, and liquidity providers earn interest during the maturity of the loan.

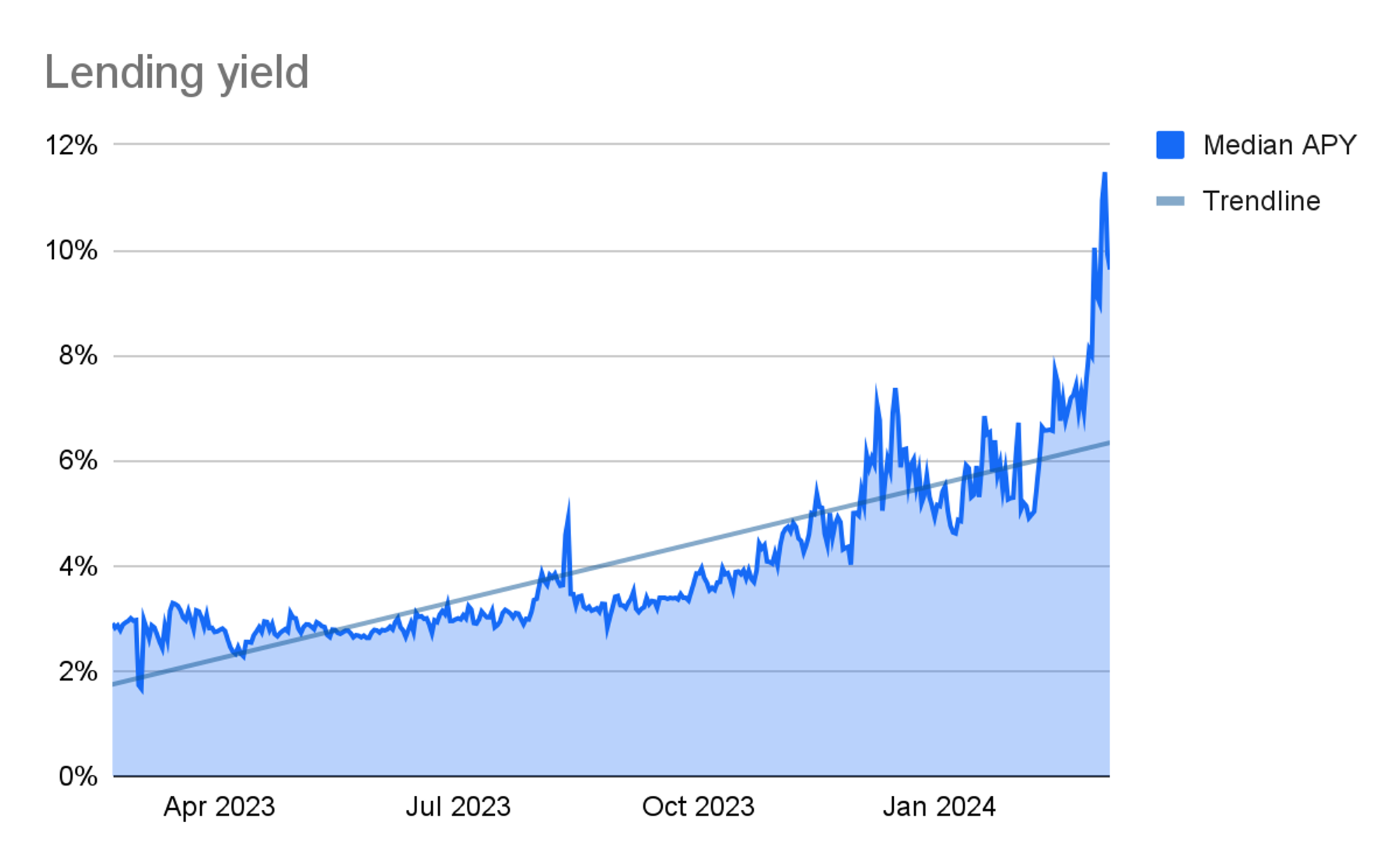

The DeFi lending sector is experiencing a revival, fueled by a collective risk-on attitude and an appetite for higher yields. The utilization model of DeFi lending markets, where interest rates are pegged to borrowing demand, has seen stablecoin borrowing rates on platforms like Aave and Compound reach double digits—a notable shift from sub-5% rates in the bear market.

This uptrend is fueled by traders leveraging stablecoins against their assets to maximize returns or explore new DeFi opportunities without triggering tax events. Innovations like Ethena, offering over 60% APY through a mix of staking returns and ETH futures contracts, are further energizing the lending sector. Finally, the integration of newer lending models such as isolated markets has enhanced the security of these platforms, encouraging more users to deposit their funds without fear of losing their collateral.

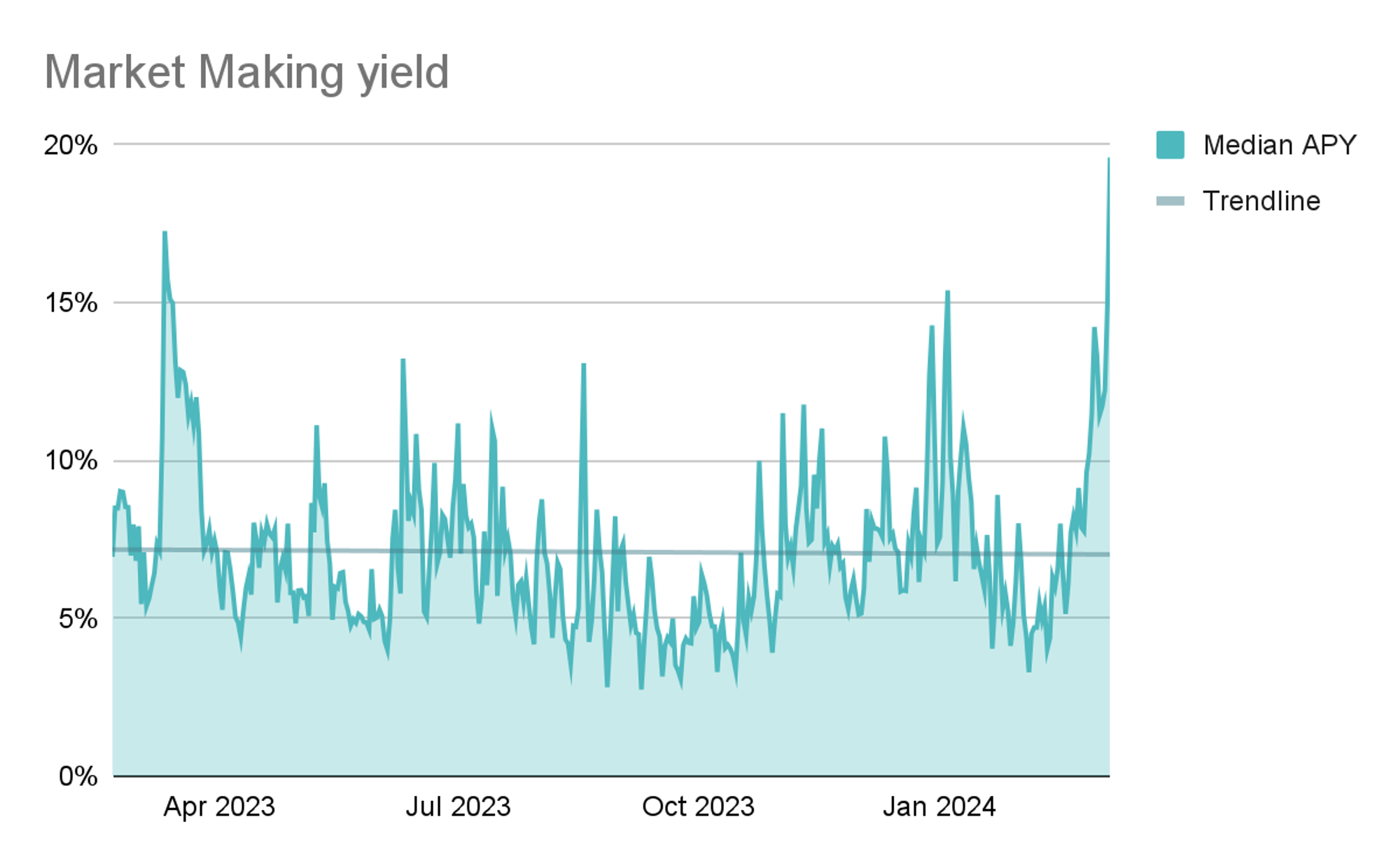

The impermanent loss challenge in Market Making

Market Making allows decentralized exchanges to provide instant liquidity for traders to swap digital assets, and liquidity providers earn commissions on trades.

Decentralized exchanges (DEXs) have faced moderated growth. The hesitance around DEXs, primarily due to fears of impermanent loss and its portrayal in the media, has contributed to a year-over-year TVL decline for most DEXs. Impermanent loss is the difference between the value of assets held within a pool compared to if they were kept outside, not accounting for the yield earned from trading fees.

Advances in capital efficiency, particularly through the concentrated liquidity model, offer higher yields with less capital but increase the risk of impermanent loss. Nevertheless, the growing popularity of "stable" pools, which experience lower volatility due to the pairing of pegged assets (e.g. stablecoins), suggests a temporary setback, as the DeFi market continues to adapt and evolve.

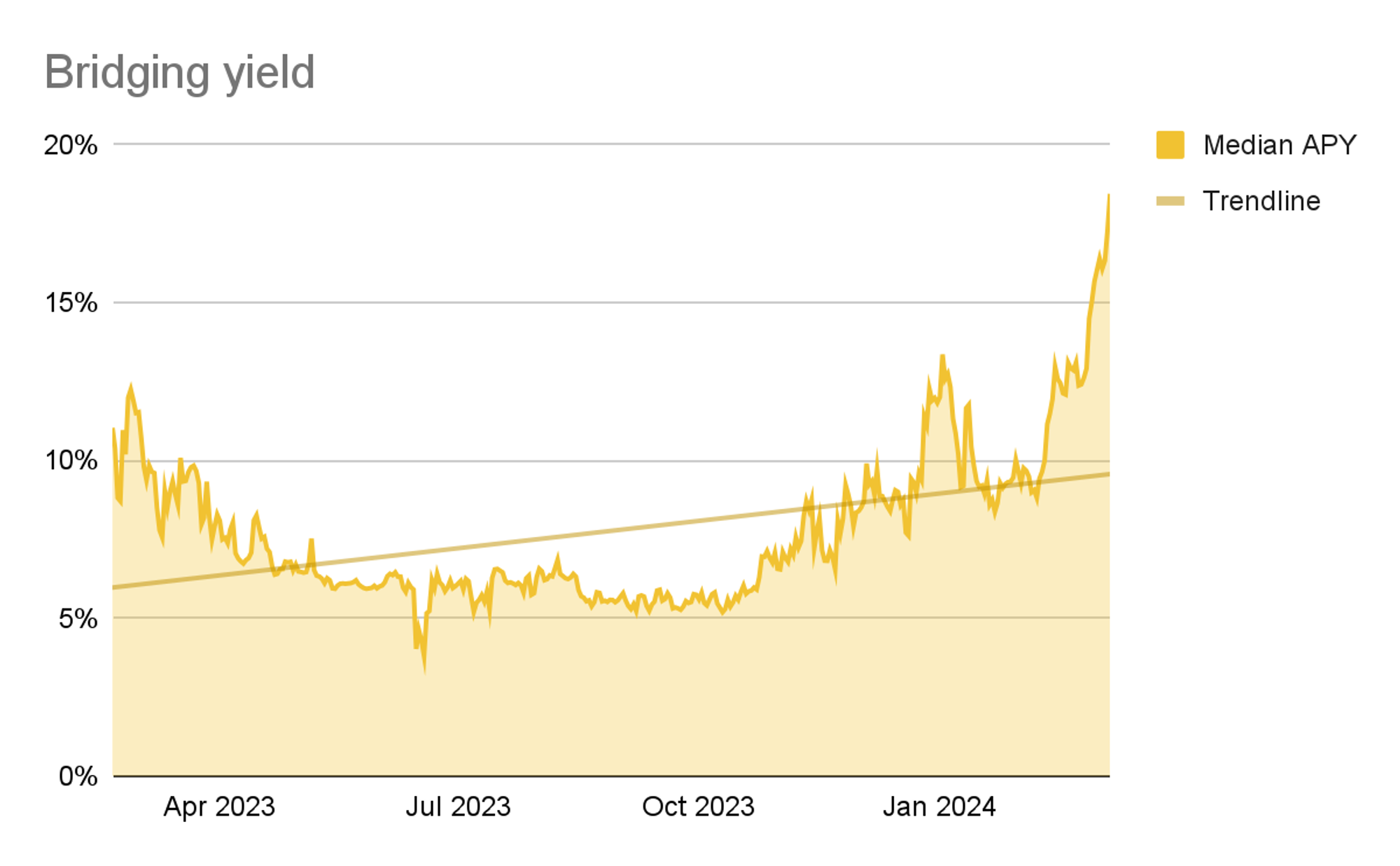

Bridging and the rise of Layer 2s

Bridging allows the transfer of digital assets between blockchain networks, and liquidity providers earn transfer fees for each transaction.

The bridging sector has witnessed a 51% TVL increase over the past year (from $94.8 million to $143.6 million), propelled by the emergence of Layer 2 rollups. As the DeFi ecosystem extends across networks, third-party bridging protocols like Across and Synapse are reaping higher fees, thanks to more secure and lucrative bridging models. The evolution toward trustless or trust-minimized models, such as optimistic bridges and zero-knowledge (ZK) proofs, marks a maturation in the bridging sector, promising a more integrated and efficient DeFi ecosystem.

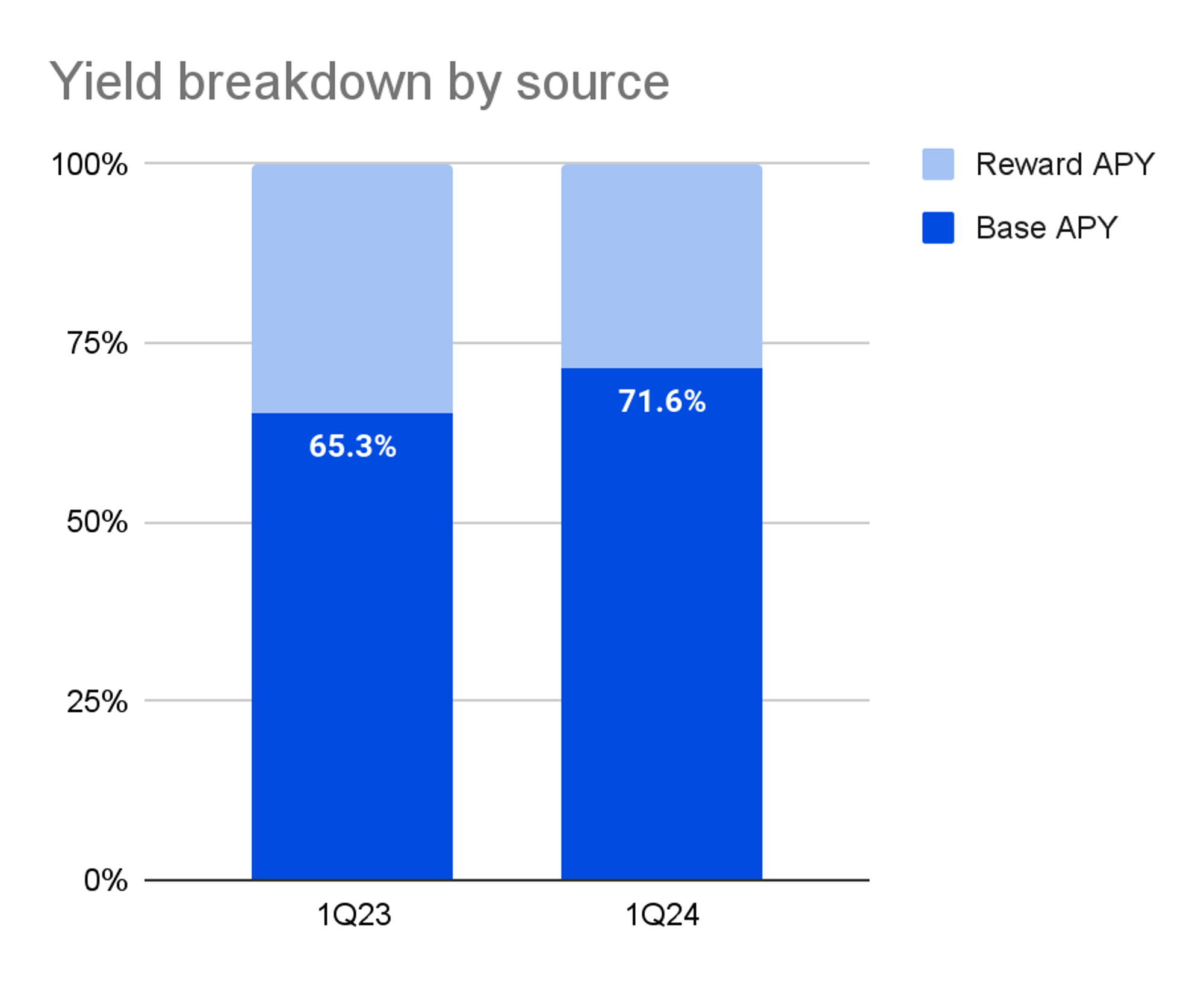

From rewards-based to activity-driven yields

A closer examination of yield components shows a reduction in the proportion of rewards-based yields, indicating a maturing DeFi market increasingly sustained by real on-chain activity. Comparing year-over-year, the rewards component has decreased from ~35% in 1Q23 to 28% in 1Q24. The shift away from incentive-based models signals a new phase of growth and sophistication in DeFi. Nonetheless, at approximately a third of the total yield, incentives continue to be a viable way to attract new users and capital in DeFi.

Conclusion

The evolving DeFi landscape reflects a community becoming increasingly judicious in its investment choices. The shift towards risk-awareness and preference for stability over speculative high yields points to a DeFi ecosystem that is not only recovering but also maturing. As we usher in a new season of growth, the future of DeFi looks promising, grounded in sustainable practices and innovative financial solutions.

Get your bull face on.