Hey Edge readers,

We may be riding the bull into the new year, but don't let the blockchain catch you slippin'. Even though we saw fewer losses last year, complacency is a greater risk than volatility. DeFi is constantly changing, and so are the risks.

Here's what we're covering this week:

- DeFi’s security issue 🚨

Billions have been lost to hackers.

- Safety-first DeFi investing 🛡️

How Exponential keeps your assets safe.

- Bitcoin ETF approved! 🎉

ETH surges as next potential ETF, new risk vectors and more.

Stay sharp. 🫡

- The Exponential team

Tackling DeFi’s security issues in 2024

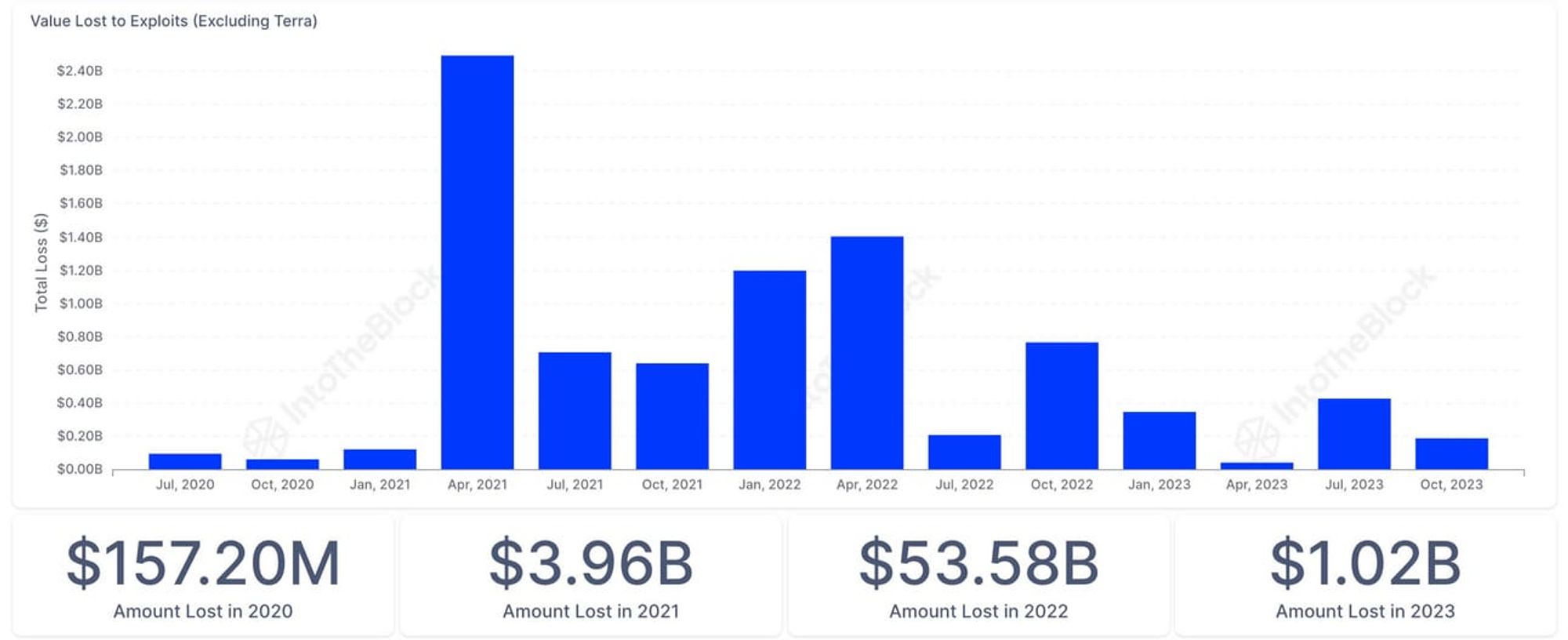

As we begin 2024, the DeFi world still faces many significant hurdles, especially when it comes to security. We've innovated with new stablecoins and groundbreaking protocols, yet we're still shadowed by the specter of security breaches. From over $50 billion lost to hacks in 2022, down to just $1 billion last year. Sounds a lot better, but let's be real — losing a billion dollars is still a massive problem.

The numbers game: What's really going on?

Okay, so the losses are down, which should be good news. But when you look closer, it's not all sunshine and rainbows. That $1 billion loss still represents about 2% of the total value locked in DeFi. Imagine if a traditional bank said, "Hey, we only lost 2% of your money this year!" There would be an uproar, right? And it's not just about the total amount lost; the frequency and sophistication of these hacks are off the charts.

Remember that mess with KyberSwap where they lost $54.7 million? Or the sneaky Ledger hack that compromised a number of prominent DeFi protocols? These aren't just random attacks; they're sophisticated, calculated moves. It's like we're playing a never-ending game of whack-a-mole, but every mole is smarter and faster than the last.

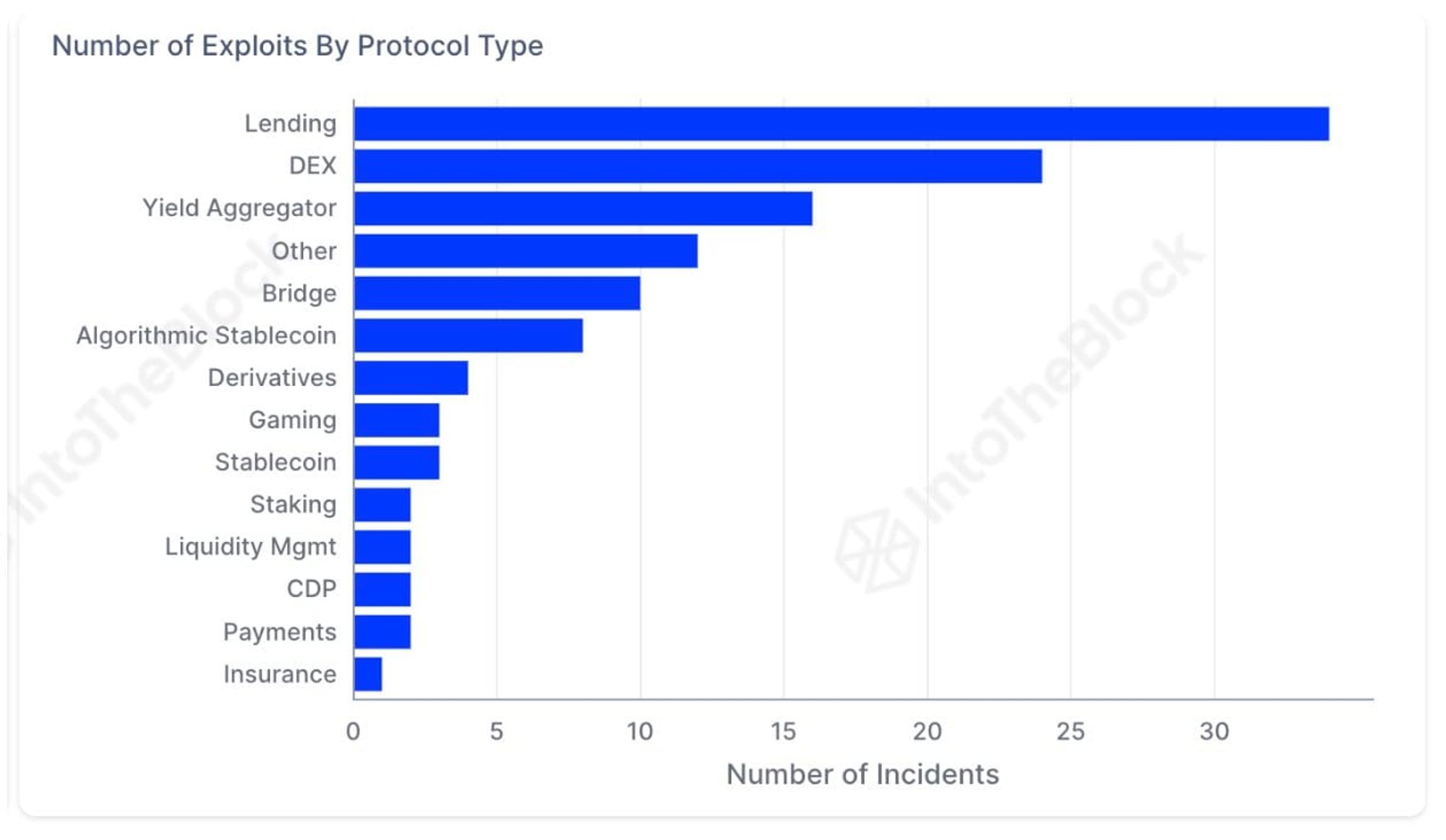

Some protocols have also been hit harder than others. Lending protocols have been exploited the most (34 attacks leading to $1.3 billion lost), while bridges have seen a larger amount of total losses ($2.7 billion exploited). Just a few days into 2024, and we’ve already seen more bridge and lending exploits!

Rebuilding trust in DeFi

Looking ahead, we can't just keep doing the same thing and expect different results. It's like telling a friend to stop dating the same type of person and then being surprised when their next relationship ends the same way. We need to switch it up, prioritize security, and get innovative. There are some cool things in the pipeline, like new risk primitives and creating smarter ways to respond to hacks. But we need more, and we need it fast.

At the end of the day, it's all about trust. We're in this bizarre situation where we're promoting a trustless system but what we really need is for people to trust it. If we want to see DeFi go mainstream, we've got to convince everyday folks and big-time institutions that their money is safe with us.

So, as we dive into 2024, let's roll up our sleeves and get to work. We need to tackle these security issues head-on and rebuild the trust that's been shaken. It's not just about protecting our investments; it's about ensuring the future of an industry that we all believe has the potential to change the world. Let's make 2024 the year we turn things around.

Exponential’s safety-first approach to DeFi investing

Secure your DeFi journey with Exponential's trusted, compliant investment solutions.

exponential.fi/blog/exponentials-safety-first-approach-to-defi-investing

In the news

- SEC finally approves spot Bitcoin ETF in historic moment - Read

- Ethereum surges past $2.4K as traders bet on next ETF approval - Read

- CFTC publishes report outlining ways to mitigate DeFi risks while noting the ‘promising opportunities’ in the space - Read

- PayPal’s PYUSD stablecoin is now part of third largest liquidity pool on Curve - Read