Hey Edge readers,

Uniswap V2 remains a cornerstone in the DeFi ecosystem with $2B+ in TVL. In this edition, we take a look at two popular pools on Ethereum mainnet, stETH-ETH and BEAM-ETH, and compare how they performed against HODL.

Here's what we're covering this week:

- Revisiting yields on Uniswap V2 🦄

We look at historical returns for two pools.

- New investable pools on Exponential ✨

Earn yield on ETH and BEAM with Lowest risk.

- Exponential interview with HackerNoon ⏱️

Our co-founder @elmidou discusses how Exponential is making DeFi more accessible.

- EigenLayer launches on mainnet 🗞️

Solana congestion, BTCFi, and more.

Stay sharp. 🫡

– The Exponential team

Revisiting yields on Uniswap V2

With over $2 billion in total value locked (TVL) and more than $4 billion in trading volume, Uniswap V2 remains a cornerstone in the DeFi ecosystem. It is one of the most battle-tested and resilient protocols in DeFi with no hacks or exploits since launching in May 2020.

V2 pools are simpler for users to understand as there is no need to provide liquidity to specific price ranges (e.g. Uniswap V3). We backtested data on two pools to determine the yield for providing liquidity and compared it to how it would have performed against holding those same assets outside the pool.

Recap of V2 mechanism

Uniswap V2 pools function as automated market makers (AMMs), allowing for the decentralized exchange of assets without requiring traditional buyers and sellers to match orders. Investors provide liquidity to these pools and in return, earn fees from trades that occur within the pool. V2 pools charge a 0.3% fee for swapping tokens. This fee is split by liquidity providers proportional to their share of the overall liquidity pool.

Case study: stETH-ETH

The first pool we looked at was the stETH-ETH pool on the Ethereum chain. This pool earns yield from swap fees paid by traders exchanging between stETH and ETH. This is a popular pool as it offers a quick way for users to exit out of their staked ETH position with Lido without waiting for the unstaking queue. As stETH is 1:1 to ETH, any variations from the price of ETH are also constantly arbitraged away, thus accruing more fees back into the pool.

The chart below shows the annualized yield that you would have earned if you had provided liquidity to this pool in December 2023. Historical yields ranged from 12-30% APY. This yield is computed against a HODL strategy, which means it represents the yield you are making compared to holding the same tokens outside of the pool.

Case study: BEAM-ETH

Another popular V2 pool is the BEAM-ETH pool, also on the Ethereum chain. BEAM is the native asset for the Beam network, a gaming network empowered by the Merit Circle DAO. BEAM is highly traded on Ethereum due to it being the governance token for one of the largest GameFi platforms in crypto.

Historical yields ranged from 25-60% APY since entering the pool in December 2023. Providing liquidity to this pool can be a good way to get GameFi exposure while earning yield from trading fees.

Conclusion

Overall, Uniswap V2 pools still offer users a great way to earn yield, without the complexities of managing liquidity ranges. You can now invest in these two pools directly on Exponential. These pools offer great risk-reward for those seeking to enhance their DeFi portfolio with low-risk, market making strategies.

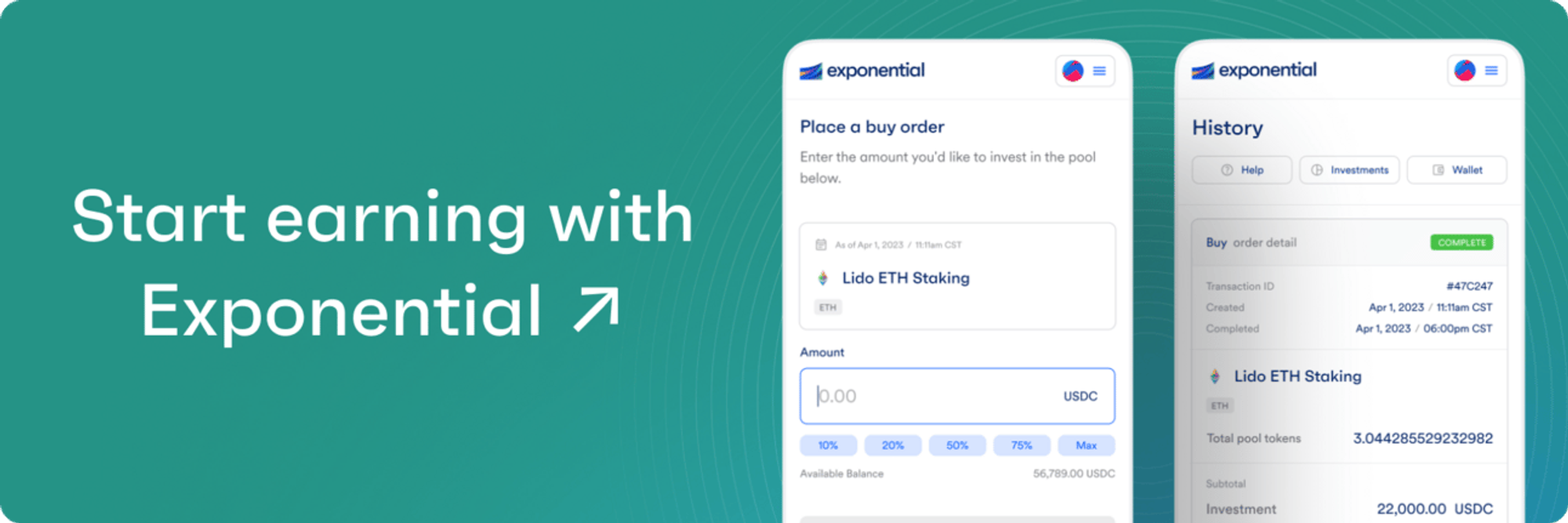

Uniswap pools are now live on Exponential! 🦄

In the news

- EigenLayer launches on Ethereum mainnet without in-protocol payments or slashing - Read

- Solana struggles with its low fee model as bots spam the network - Read

- Liquid staked Bitcoin is coming to holders as a new yield vehicle - Read

- New restaking protocol, Karak, introduces ‘universal restaking’ for any asset on any chain - Read

- Ethena adds BTC as a collateral asset for USDe - Read