Stablecoins have been a source of calm during some pretty big crypto storms. They’ve carved a niche for themselves by being the equilibrium point in the dynamic world of cryptocurrency. Acting as a bridge between traditional finance and the progressive realm of decentralized finance (DeFi), they infuse a necessary dose of stability in the otherwise volatile world of crypto assets.

Designed to maintain a consistent value in relation to a particular asset or a pool of assets, stablecoins are meant to be insulated from drastic price fluctuations. As a result, they prove highly beneficial as a reliable store of value and as a practical currency for daily transactions, blending the best of both worlds.

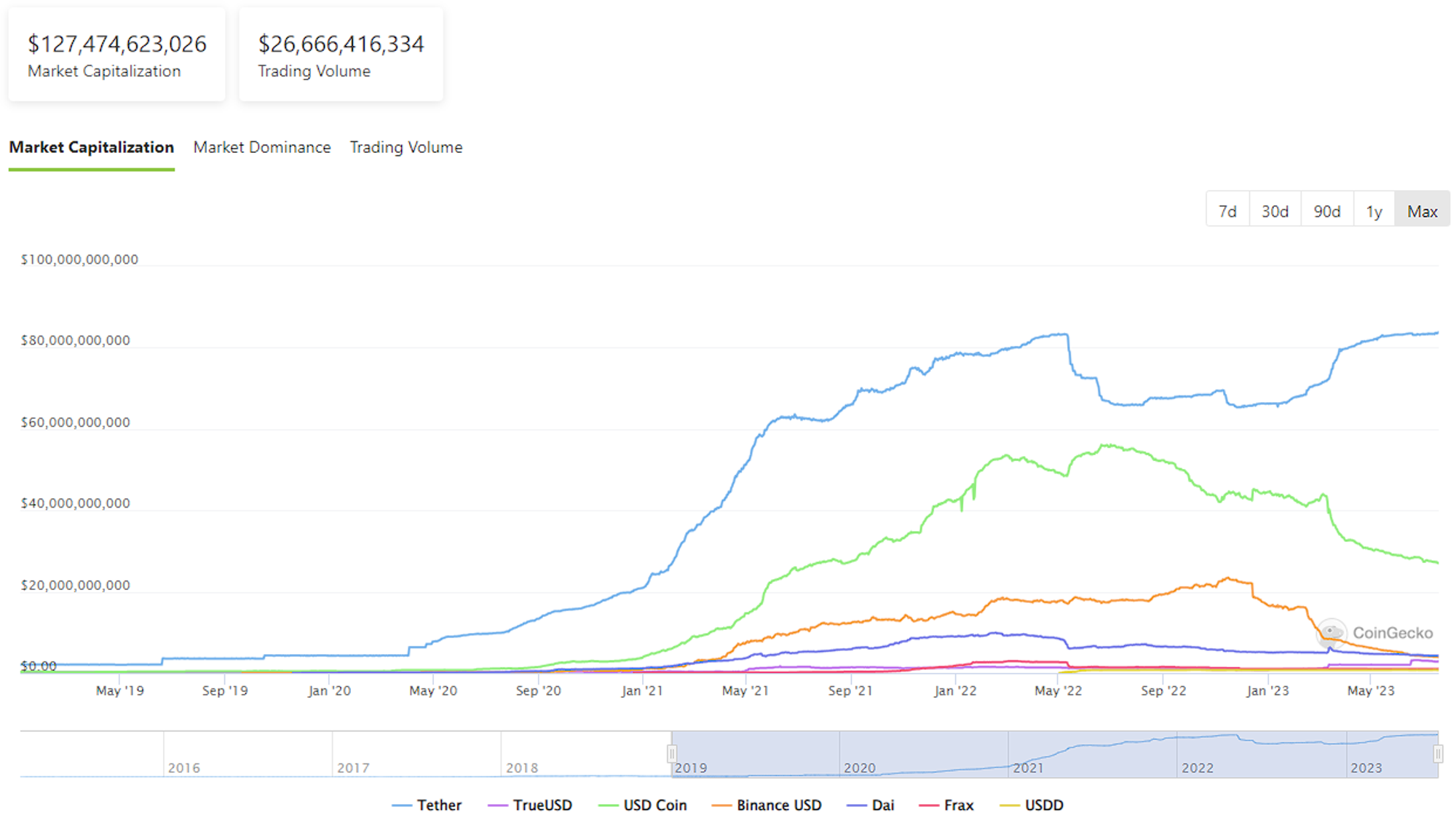

Today, the stablecoin sector stands as one of the largest opportunities in the crypto market, with a total market cap exceeding $120B. However, all stablecoins are not made equal -- they differ in terms of their backing or underlying collateral, their stability mechanisms, and even their degrees of decentralization.

In this blog post, we'll dive into the diverse landscape of stablecoins, unpacking the different types and the unique challenges they face in their quest for balance between decentralization, stability, and capital efficiency - the trifecta commonly known as the Stablecoin Trilemma. As you journey through this piece, you’ll gain insights into how these stablecoins function, how they compare, and what role they play in shaping the future of finance.

Types of stablecoins

In the world of stablecoins, we generally see three types based on what backs or supports their value.

Fiat-backed stablecoins

These stablecoins (you may have heard of USDC and USDT) are supported directly by regular, government-issued money (we call these 'fiat currencies') like the USD or EUR that's kept safe in a reserve. They keep their value stable by trying to keep a 1:1 ratio with the fiat currency they're backed by. In theory, this makes them transparent and reliable. But, remember, there's always a bit of risk involved. These stablecoins depend on centralized institutions that issue and manage them, which means there's a 'counterparty risk.'

Another category of fiat-backed stablecoins is commodity-backed stablecoins. These are backed by commodities like gold, silver, or oil. Take PAXG (Paxos Gold), for example. This stablecoin is backed by actual gold that's kept in special vaults (LBMA vaults) in London. So, holding PAXG is kind of like holding a claim on the real gold it's backed by.

Crypto-backed Stablecoins

Crypto-backed stablecoins like DAI, crvUSD, and MIM are supported or ‘collateralized’ by a mix of crypto assets, including fan favorites like ETH and WBTC. These stablecoins employ smart contracts via decentralized protocols to maintain their peg to a specific value.

But given the rollercoaster-like nature of crypto assets, these stablecoins usually need something extra - overcollateralization. This provides a bit of a safety net against potential defaults. However, it's important to keep an eye on the quality of collateral backing these stablecoins. WBTC, for instance, is often used as collateral for minting crypto-backed stablecoins, mostly because it's one of the few DeFi-friendly versions of BTC out there. But, it comes with a caveat. It's centralized, with BitGo playing custodian for the underlying BTC.

This leads to protocols constantly trying to strike the right balance between stability and growth.

Some collateral-backed stablecoins aim for a high level of decentralization by accepting only one type of asset as collateral. For example, LUSD solely utilizes ETH, which is uncensorable, as collateral. By only accepting ETH as collateral, LUSD provides stronger guarantees around stability and decentralization. Interest-bearing stablecoins, like eUSD, offer an additional benefit to holders – the ability to earn interest income. These stablecoins generate interest for holders by accepting collateral from decentralized staking protocols (i.e., stETH). This feature enables users to not only maintain a stable value but also generate a yield on their holdings, making them a nice hedge against inflation.

Algorithmic Stablecoins

Algorithmic stablecoins, like FRAX and USDN, use various on-chain mechanisms to maintain their peg. Unlike the other types of stablecoins, these stablecoins are not backed directly by any collateral (referred to as “undercollateralized”). Instead, their value is generally tied to another sister asset and/or relies on algorithms to expand or contract their supply based on market demand. These mechanisms can be complex and often produce reflexive relationships that can ultimately lead to a death spiral. As we saw with the collapse of UST, when an undercollateralized stablecoin loses its peg, and users lose confidence, massive bank runs can ensue to destabilize the entire system.

The Stablecoin Trilemma

While stablecoins offer stability and utility in the crypto market, they face a challenge known as the Stablecoin Trilemma. This refers to the tradeoffs that stablecoins must navigate between three key factors: decentralization, stability, and capital efficiency.

Decentralization, the absence of a central authority or intermediary control, is a fundamental principle of crypto assets. Yet, achieving full decentralization in stablecoins presents a challenge. This is particularly evident in fiat-backed stablecoins, where centralized institutions issue and manage the stablecoin reserves. The reliance on centralized entities introduces counterparty risk and raises questions about censorship resistance and trust.

Stability is another crucial aspect of stablecoins as they aim to maintain a 1:1 value relative to a pegged asset, usually a fiat currency like USD. Achieving stability requires healthy collateral, algorithmic mechanisms, or other measures to ensure that the stablecoin's value remains constant. This is especially difficult for crypto-backed or algorithmic stablecoins, as they rely on the quality and liquidity (on-chain and off-chain) of the underlying collateral or complex on-chain mechanisms.

Capital efficiency refers to how much money is needed to create each individual stablecoin. In essence, it's answering the question: "Does it cost more or less than $1 to make a stablecoin worth $1?"

Consider stablecoins like DAI, which aren't as efficient. To make a $1 DAI stablecoin, you actually have to lock up $1.20. So the less money it costs to create a new stablecoin, the more 'capital efficient' we consider it to be. But of course, there's a catch. Trying to be efficient often means making some compromises, which could lead to more centralization or possibly even affecting the coin's stability.

Stablecoin issuers must carefully weigh out these tradeoffs based on their specific goals and target use cases. Some stablecoins prioritize decentralization, aiming to minimize reliance on centralized entities and maximize censorship resistance. However, this approach may come at the expense of stability or efficiency. Others focus on stability as their primary objective, using overcollateralization to maintain their peg. These stablecoins may sacrifice some decentralization to achieve stability and efficiency.

Ultimately, finding the right balance between decentralization, stability, and efficiency is an ongoing challenge in the stablecoin landscape. Protocols must carefully assess their priorities and the tradeoffs associated with each factor to determine the most suitable approach for their stablecoin design.

Comparison of top stablecoins

Now that we've laid the groundwork for understanding the unique challenges and tradeoffs that different stablecoins face, we’ll take a look at real-world examples and compare the top stablecoins currently dominating the market. By bringing together our understanding of the Stablecoin Trilemma and their individual properties, we'll provide a comprehensive risk table that ranks these stablecoins based on our unique risk framework. The goal of this analysis is to help you understand how these theoretical ideas actually work in the real world. With this knowledge, you'll be better equipped to make informed decisions when choosing which stablecoin to use.

USDT

USDT has the most Lindy effect of any stablecoin to date since it’s been around the longest and has always regained its USD peg. This resilience has led the fiat-backed stablecoin to dominate the industry with over $80B in circulation, accounting for over two-thirds of all stablecoins. Despite its track record, there is still some skepticism around whether USDT is fully backed 1:1 by its underlying reserves.

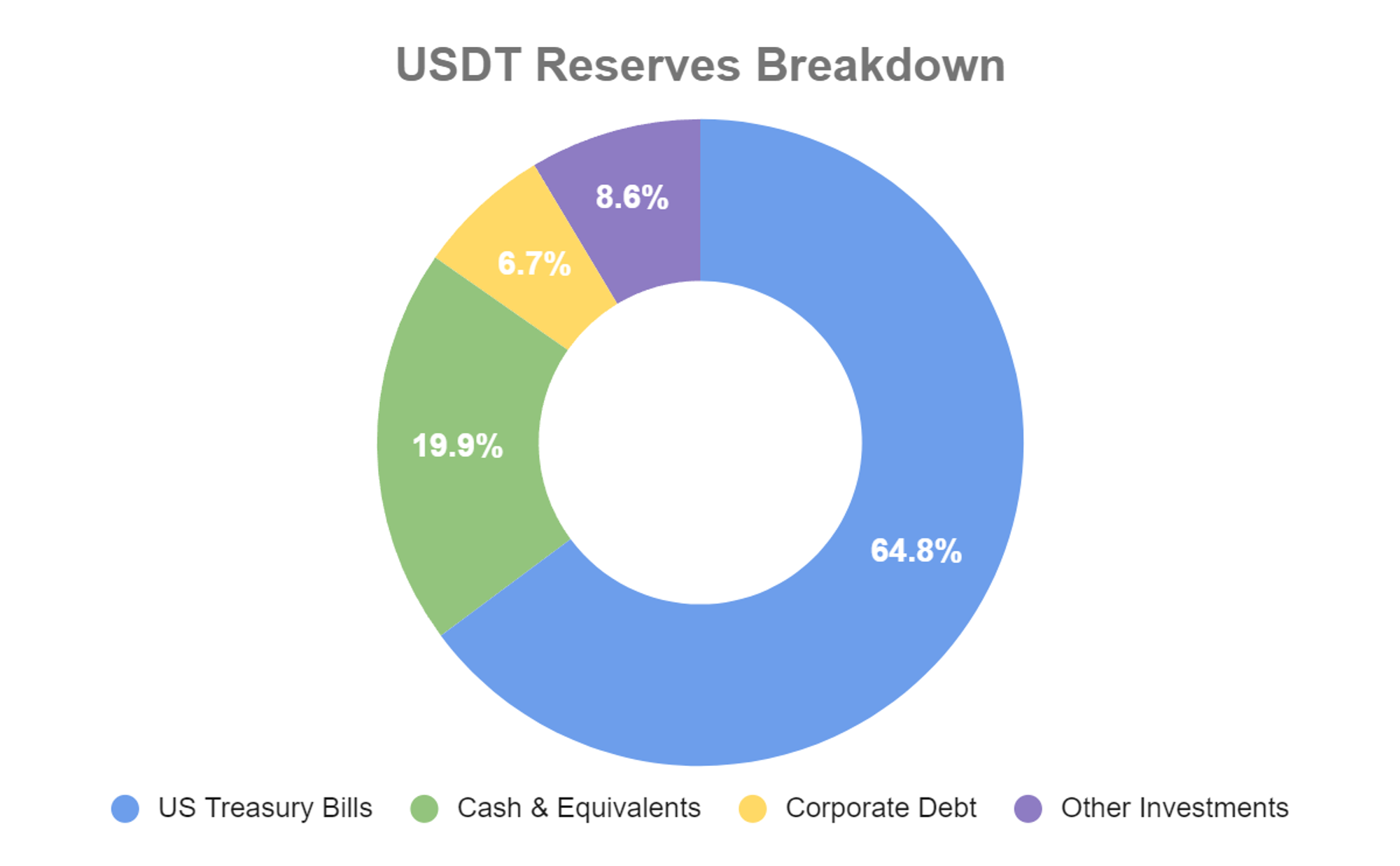

A quick analysis of USDT’s reserve breakdown showcases the glaring problem with fiat stablecoins. Users have to always trust that Tether won’t misplace or misuse their funds, a concept that goes against the core tenets of crypto and DeFi. For example, Tether has been subject to intense regulatory scrutiny for previously claiming that every USDT is backed by 1 USD. In reality, Tether had diversified its reserves into more risky assets like corporate debt and “other” investments with limited clarity on their exact composition.

Source: Tether (as of March 2023)

Nonetheless, market participants have still favored USDT as their preferred stablecoin for trading on centralized exchanges. Its primary appeal lies in its low volatility and high liquidity, features that make USDT ideal for trading. Users can quickly move into and out of volatile assets without having to leave the crypto ecosystem. Larger institutions may also favor USDT, given their direct access to Tether’s redemption mechanism, allowing them to arbitrage any depegs that occur. However, they may not be the best choice for long-term value storage due to their centralized nature and the counterparty risks associated with the institutions that issue and back them. These institutions have blacklist capabilities to freeze any of their on-chain assets at will.

USDC

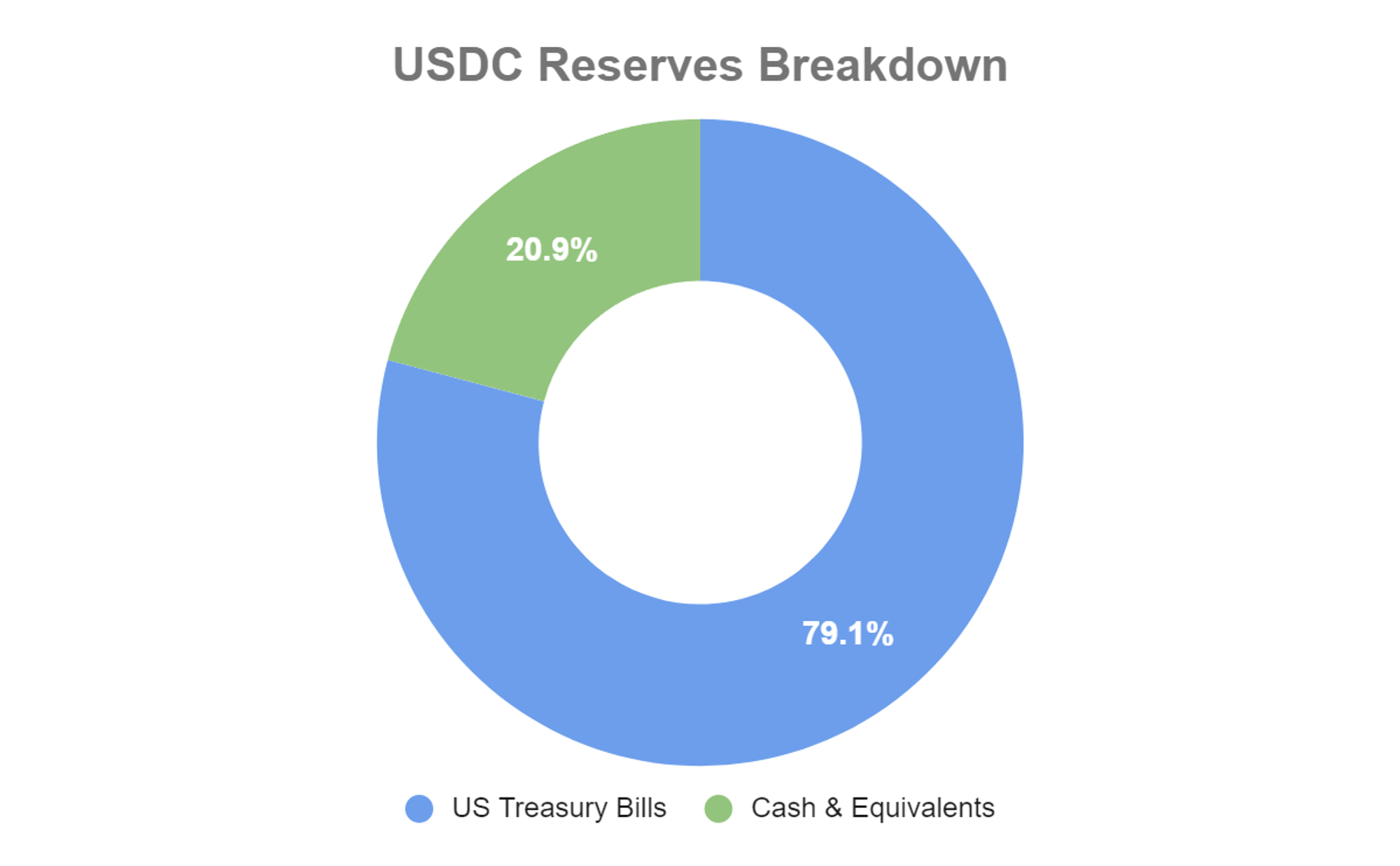

USDC is a prominent fiat stablecoin that is issued by Circle. Unlike Tether, Circle has provided far greater transparency on its reserves, which only hold cash deposits and short-dated US Treasuries. The combination of more conservative reserves and deep on-chain liquidity has led USDC to be widely regarded as one of the safest stablecoins on the market. Nonetheless, USDC faced its own significant stress test earlier this year as part of its cash reserves held at Silicon Valley Bank came under fire due to the bank’s sudden collapse. This yet again highlighted the counterparty risks associated with fiat-backed stablecoins.

Source: Centre (as of May 2023)

The main benefit to USDC is its deep liquidity on-chain with usage across both decentralized exchanges (DEXs) and money markets, making it one of the most used stablecoins in DeFi. The majority of liquidity pools on DEXs are either paired with ETH or USDC, which makes it highly efficient for users to swap in and out of assets with low slippage. Most protocols also accept USDC as a form of collateral or deposit, further increasing its usability across DeFi. Lastly, USDC provides more stability guarantees for retail users who have the ability to convert 1:1 to USD reserves through Circle or Coinbase.

DAI

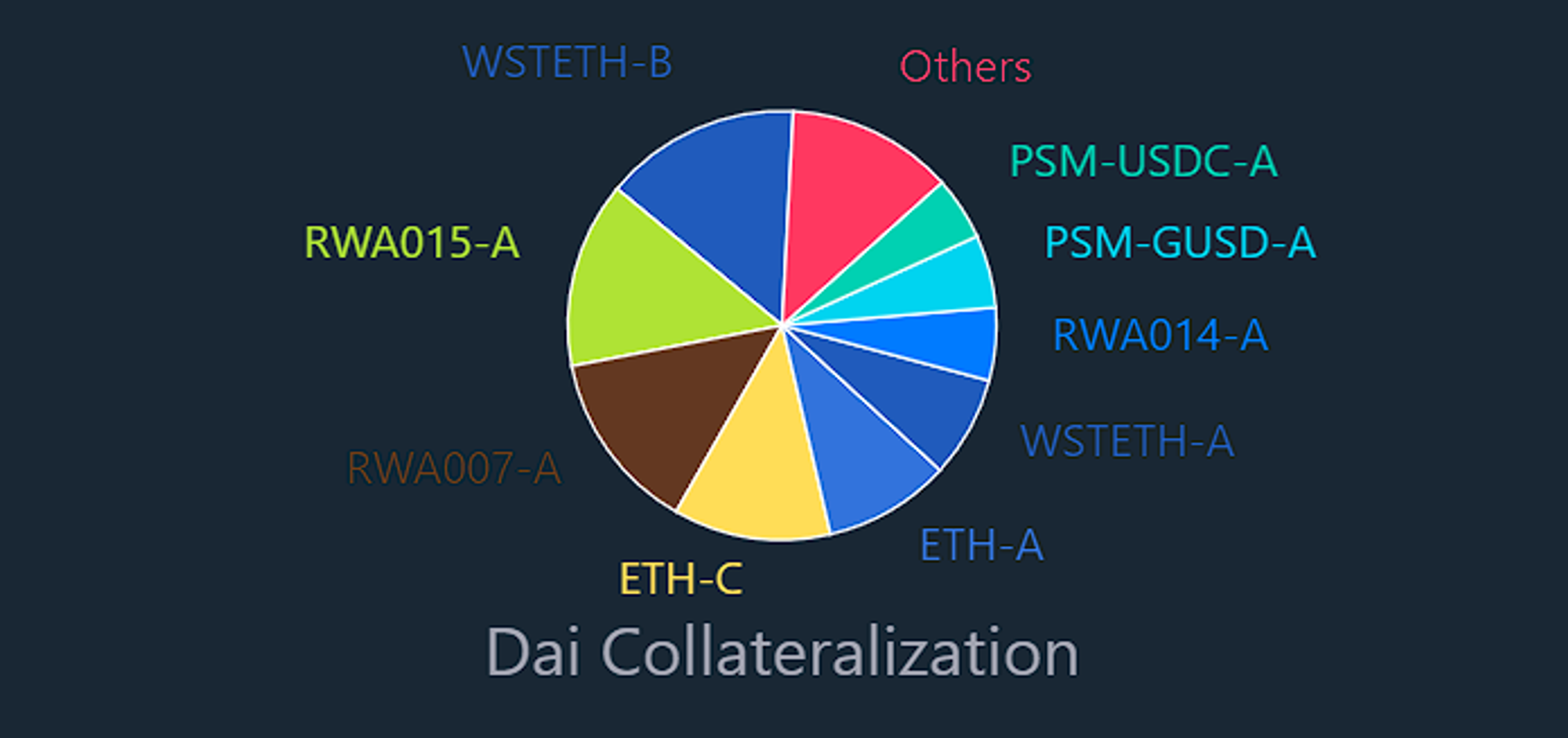

This crypto-backed stablecoin is a star player in the DeFi world. It is the most popular stablecoin that follows the overcollateralization model with various on-chain and off-chain reserves, including ETH, USDC, WBTC, as well as real-world assets (RWAs) like US Treasuries. Users can enjoy a risk-free savings rate through the DAI Savings Rate (DSR) feature, which allows them to earn interest on their DAI holdings. The main benefit to holding DAI is that its reserves and governance are on-chain

While DAI is mostly decentralized, it's worth noting that it does have potential third-party risks associated with its underlying collateral due to its exposure to centralized assets like USDC, GUSD, and RWAs. The main risk would be if a black swan event impacted its collateral assets (i.e., USDC depeg), in which case DAI’s reserves may not be able to handle all redemption needs.

LUSD

LUSD is gaining popularity, especially with users who value complete decentralization and are looking to borrow money against their ETH assets at low costs. The great thing about LUSD is that it carries no counterparty risk – meaning you don't have to worry about the other party failing in their part of the deal. Coupled with its stable nature, this makes LUSD a solid option for storing value over a long period, or for big investors often known as 'whales.'

Even better, LUSD is being used more and more in combinations or 'liquidity pools' with ETH for a practice known as yield farming. This is another way to make a profit in the DeFi world, which increases the ways you can use LUSD.

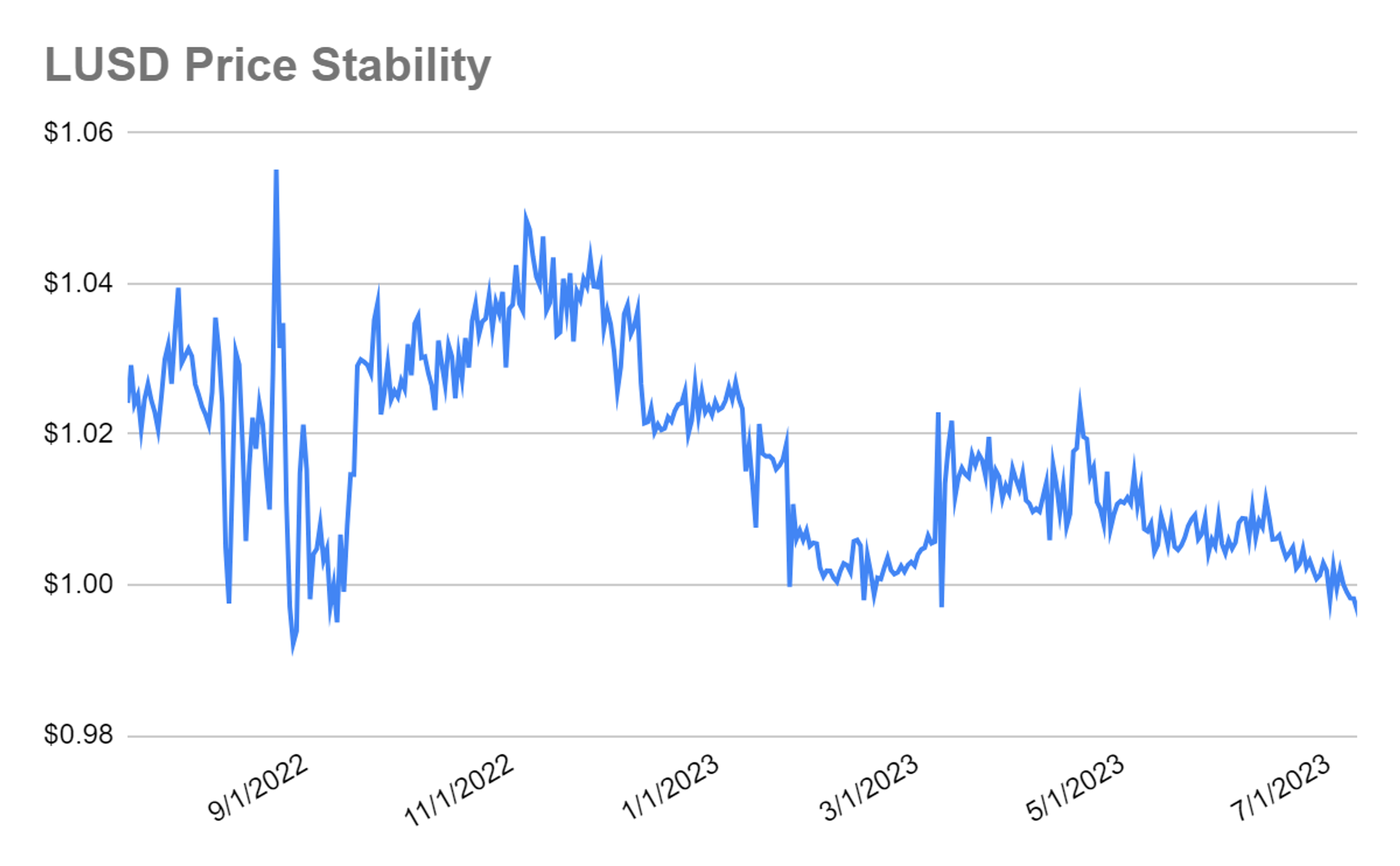

The main appeal of LUSD is the fact that it is completely immutable, and ETH is the only accepted collateral to mint LUSD. This combination makes it the most censorship-resistant stablecoin on the market today. LUSD provides strong peg stability guarantees as ETH is highly liquid and one of the most decentralized assets. In fact, LUSD has mostly had an issue of “depegging” to the upside. This was partly driven by higher demand as a result of recent events with the USDC depeg and death spirals associated with algorithmic stablecoins. The only drawback is that LUSD is less capital efficient, given the protocol only accepts one type of collateral and requires $1.10 worth of ETH to mint 1 LUSD.

FRAX

FRAX introduces the concept of an undercollateralized stablecoin, enabling the system to operate with a lower collateral ratio (below 100%) while maintaining its stability. This unique mechanism contributes to capital efficiency and reduces over-collateralization issues common in crypto-backed stablecoins. However, this means FRAX also carries significant collateral risk due to it being partially backed by its native FXS token, which expands and contracts its supply as FRAX is minted or burned. This makes it highly vulnerable to bank runs, as a loss of confidence in FRAX can lead to a death spiral as FXS floods the market. The remaining collateral consists of USDC, which also introduces counterparty risk.

As an algorithmic stablecoin, FRAX opens up opportunities for earning higher yields on stablecoins. It is often paired with other stablecoins in liquidity pools to improve its on-chain liquidity. These pools typically offer high incentives to attract yield-seeking risk-takers who understand the nuances of FRAX’s economic design. Users can farm these token rewards for a higher yield, taking advantage of algorithmic mechanisms that balance its supply to maintain stability. But, as with all algorithmic stablecoins, it's important to be mindful of the potential complexity and risk involved.

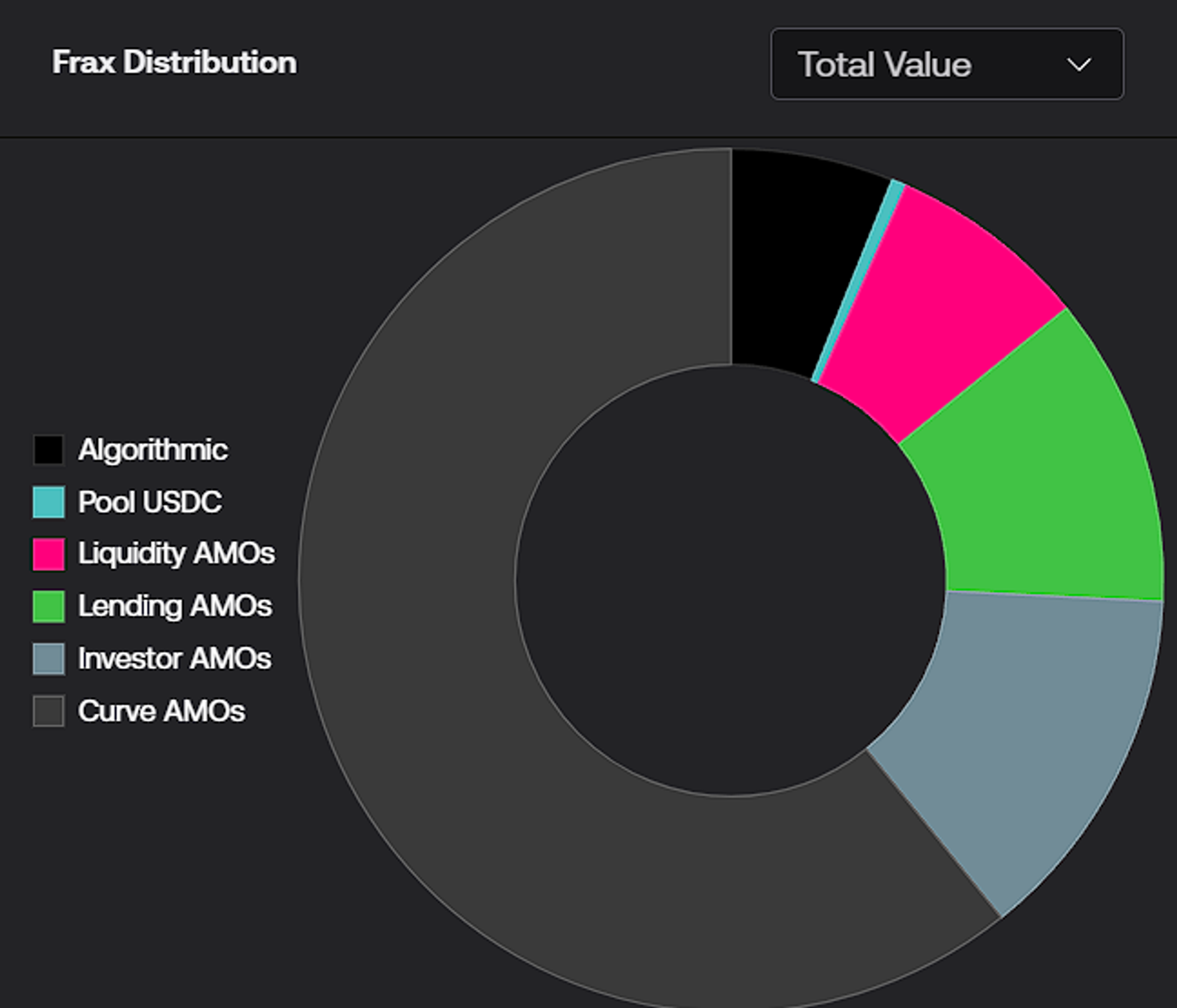

In the heart of FRAX's system are Algorithmic Market Operations Controller (AMOs) that operate as a unique ecosystem of 'central banking legos'. AMOs are fully autonomous contracts that can perform a wide array of market operations, all while preserving FRAX's peg to USD. The power of AMOs lies in their ability to fine-tune the collateral ratio (CR) based on the prevailing market price of FRAX. When FRAX trades above $1, AMOs decrease the CR, stimulating an expansion in the supply of FRAX. Conversely, when FRAX's price falls below $1, they increase the CR by burning FRAX in existence, pulling the system back into balance.

It is worth noting that whenever the AMOs stimulate the expansion of FRAX, this incremental supply is commonly not backed by collateral but rather backed by the implicit guarantee that the protocol management will not release it in circulation. The incremental FRAX is deposited in liquidity pools at known DEXs such that the newly minted FRAX is injected as liquidity to reduce the price back to $1. When the AMOs want to contract supply, they remove the injected liquidity and burn the supply. This is a similar mechanism to how central banks manage liquidity to target a benchmark interest rate.

Stablecoin Risk Table

This table evaluates stablecoins for potential risks based on four factors: counterparty, collateral, stability, and liquidity. Counterparty risk is when the stablecoin issuer or custodian fails to fulfill their obligations or becomes insolvent. Collateral risk is when the assets supporting the stablecoin decrease in value. Stability risk is when the stablecoin deviates from its peg. Liquidity risk is when the stablecoin has low liquidity or high transaction costs.

Takeaways

Stablecoins are undeniably one of the hottest topics in the crypto space. Their unique ability to hold a steady value makes them a great choice for all sorts of users. The race is still on to create the ultimate stablecoin – a coin that strikes the perfect balance between the three aspects of the Stablecoin Trilemma.

So far, fiat stablecoins like USDT and USDC have taken the lead due to their high stability and liquidity. They still have their own challenges around centralization and regulatory issues, which aren’t likely to go away anytime soon. In the long run, we need a real crypto-native solution that aligns with the ethos of a decentralized financial market.

Crypto-backed stablecoins, like LUSD and DAI, seem to be on the right track. However, they're not quite there yet in terms of efficiency to grow on a large scale and they have to tackle their own hurdles around collateral quality. Algorithmic stablecoins like FRAX bring innovative methods to the table to improve capital efficiency while keeping things decentralized, but they fall a little short on stability due to being undercollateralized.

When it comes to choosing a stablecoin, it really depends on your own personal needs, your risk appetite, and how involved you want to be in the crypto and DeFi space. Each stablecoin has its own mix of pros and cons, opportunities and risks, which users need to evaluate carefully. As the stablecoin landscape keeps evolving, we're bound to witness new innovations in how stablecoins are designed and how they balance the decentralization-stability-capital efficiency trifecta.

Signup today to Exponential and invest in DeFi from a simple and secure platform.