Hey Edge readers,

This week, we're diving into the mechanics behind derivatives, how they serve as a tool for risk management and speculation in DeFi, and ways to earn yield as a liquidity provider.

Here's what we're covering this week:

- Derivatives explained 🧠

Learn how derivatives serve as a crucial instrument in DeFi.

- Spotlight on perpetual pools 🏊♂️

Explore top perpetual pools to earn from trading activities.

- Bitcoin grows to $50K+

CoW AMM launches, Bitcoin ETF inflows and more.

Stay sharp. 🫡

– The Exponential team

How DeFi derivatives works

Learn about derivatives in DeFi, including how it works, the associated risks and advantages, and the top platforms in the space.

exponential.fi/blog/how-defi-derivatives-works

Spotlight on perpetual pools

These pools feature perpetual protocols that allow you to trade crypto assets with leverage. A perpetual contract is a type of derivative instrument that uses crypto as collateral to open a leveraged position but doesn’t have an expiration date. As a liquidity provider, you earn from trading fees but also serve as the counterparty for traders’ gains and losses.

1. GMX BTC-USD Market Making - 21% APY

2. GMX ETH-USD Market Making - 20% APY

3. GMX ARB-USD Market Making - 26% APY

4. GMX SOL-USD Market Making - 37% APY

5. Gains USD Market Making - 16% APY

Think of it as similar to a casino, where you, the liquidity provider, assume the role of the house, and traders are like gamblers, betting on the direction of asset prices. While there will always be some profitable traders, the house advantage is that over time, there are likely more losing traders than winners.

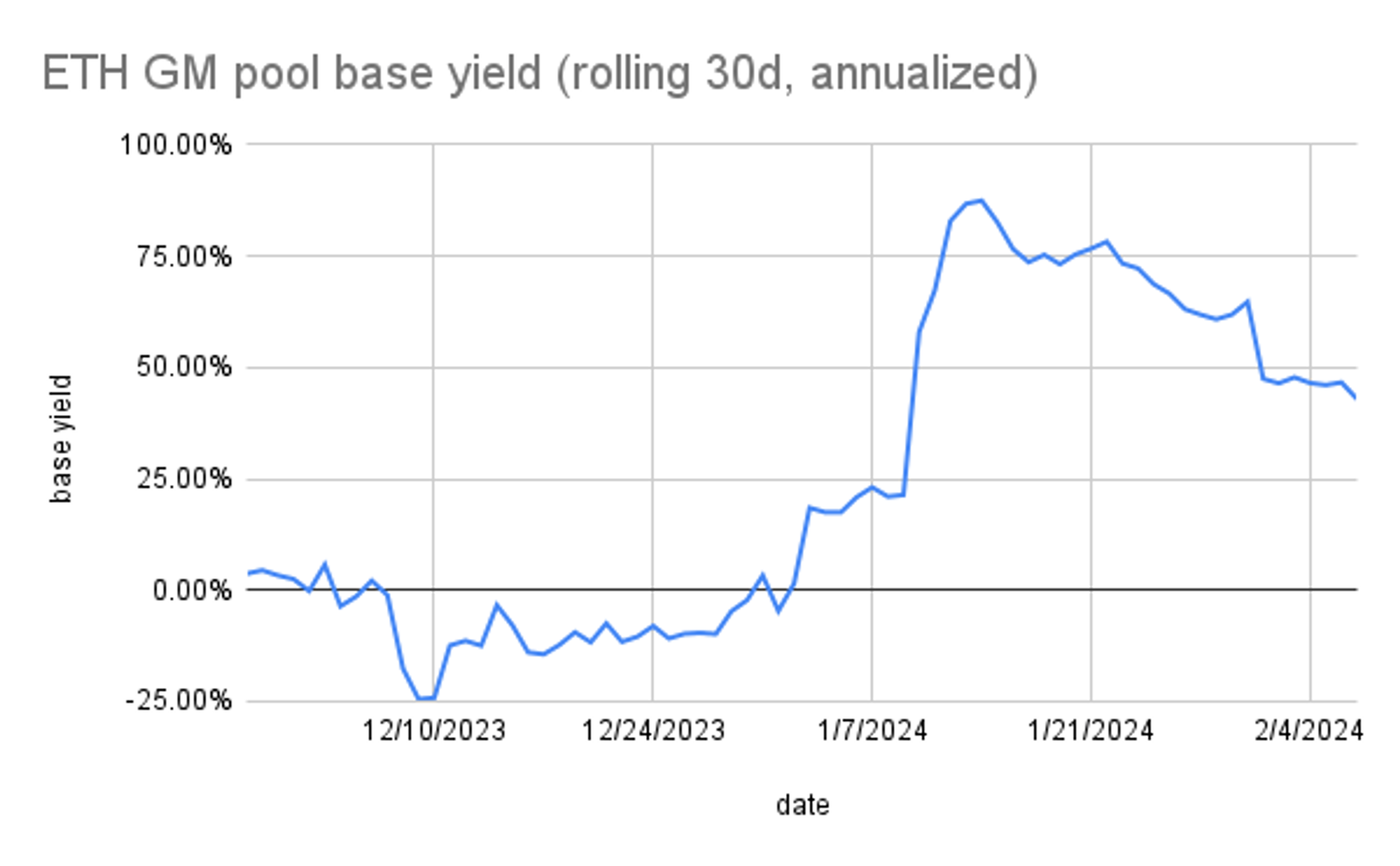

We see this dynamic play out in the GMX ETH-USD pool’s performance above. After a period of lower or even negative yields—reflecting a streak of trader wins—the tables have turned since the start of the new year. Traders' losses have reversed the trend, catapulting liquidity providers' yields to impressive levels!

What type of pools would you like to invest in through Exponential?

Subscribe to participate in polls.

In the news

- Bitcoin above $50K as crypto markets rally amid bullish sentiment - Read

- Ethereum traders make $120 million using a 'looping strategy’ - Read

- New ERC-404 tokens are the latest craze to hit Ethereum - Read

- CoW Swap introduces a new AMM that is designed to solve issue of impermanent loss - Read

- Starknet plans broad token distribution later this month - Read