Hey Edge readers,

This week, we look into the first set of restaking options live on EigenLayer, exploring how these services are set to benefit the Ethereum ecosystem, and ways to earn potential airdrops.

Here's what we're covering this week:

- How to farm EigenLayer

We look into the first set of restaking options live on EigenLayer.

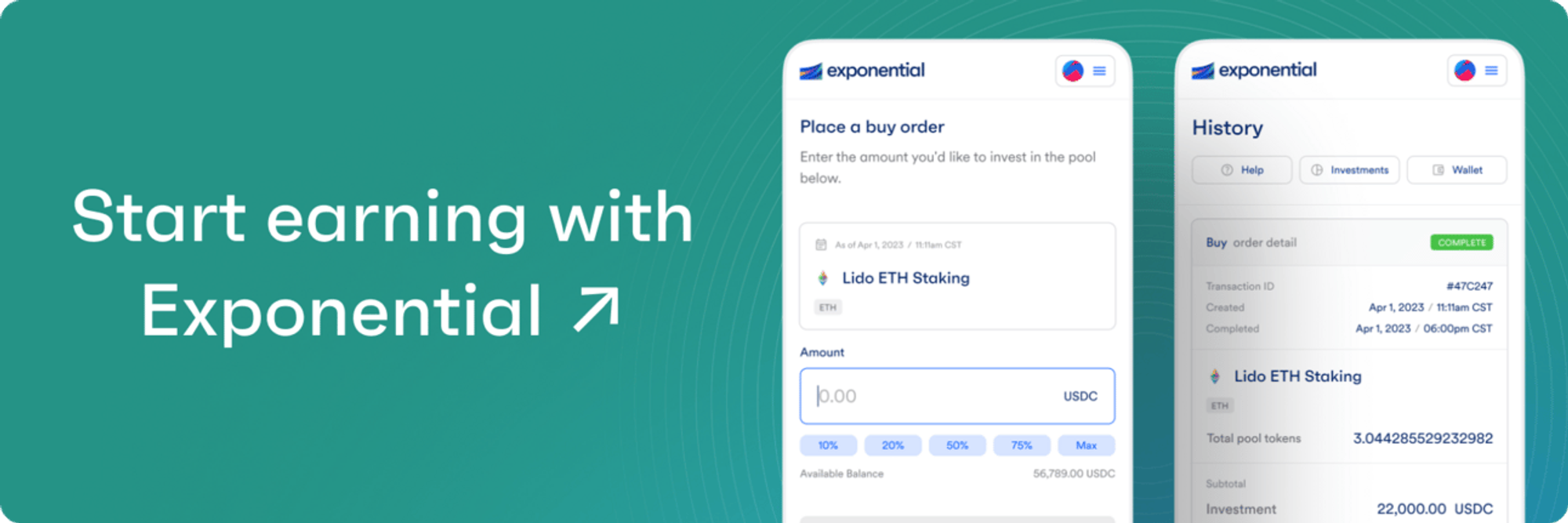

- Video: A closer look at Exponential.fi features

First time users can earn a special bonus!

- Bitcoin halving nears 📰

Memecoins on Bitcoin, World Chain, and more.

Stay sharp. 🫡

– The Exponential team

How to farm EigenLayer

Last week marked a significant milestone for EigenLayer with its mainnet launch, beginning with the first set of restaking services going live, otherwise known as Actively Validated Services (AVS) in the DeFi world. For a recap on restaking, see our previous Edge post and our EigenLayer risk report.

This week, we delve into the role and function of AVS within EigenLayer, how they enhance Ethereum, and the range of services they provide. We'll also explore the associated risks and farming strategies available to earn potential airdrops.

What is the role of AVS within EigenLayer

AVS, secured by EigenLayer restakers and operated by EigenLayer operators, are specialized middleware designed to optimize and secure various blockchain functions. These services range from data availability layers to oracle networks and cryptographic frameworks, each contributing uniquely to enhancing blockchain efficiency and security.

There are three types of participants in restaking:

- Operators: Provide validation services for AVS, enhancing their functionality and reducing operational costs.

- Native restakers: Stake ETH, either as native tokens or Liquid Staking Token (LSTs), to provide cryptoeconomic security to the AVS, earning rewards and protocol fees in return. Native restakers choose the specific Operators to delegate their ETH or LST.

- Liquid restakers: Stake ETH with a Liquid Restaking protocol that issues a deposit receipt that allows you to retain liquidity of staked ETH and deploy it within DeFi. Here, the DAO or protocol team is ultimately in control of what AVS to opt-in to.

Current AVS on mainnet

Currently, mainnet brings a dynamic group of services to the ecosystem:

1. EigenDA: EigenDA tackles data availability for Ethereum rollups by allowing for off-chain data storage while maintaining on-chain metadata and accountability processes. This approach facilitates scalability without compromising security or decentralization.

2. MACH Restaked Rollups by AltLayer and Xterio: These services provide fast block finality and are designed to validate transactions swiftly and securely, enhancing the Ethereum user experience.

3. Brevis’ Coprocessor: A Zero-Knowledge (ZK) Coprocessor that allows for efficient and secure computations based on historical blockchain data, useful for advanced DeFi applications and other data-driven services.

4. Eoracle: An Ethereum-native oracle network that integrates real-world data into blockchain applications, facilitating a broad range of decentralized applications.

5. Lagrange's State Committee: Offers light client functionality for secure communication between rollups and blockchains, improving interoperability and security.

6. Witness Chain's DePIN Coordination Layer: This service enhances the security and functionality of decentralized physical networks by integrating proof systems like Proof-of-Location and Proof-of-Bandwidth.

How AVS can enhance the Ethereum ecosystem

These services enhance the capabilities of the Ethereum ecosystem through several key mechanisms:

- Scalability and efficiency: By handling specific functions such as data availability, computation, and cross-chain communication off the main Ethereum chain, AVS help alleviate congestion and reduce transaction costs on Ethereum’s mainnet.

- Enhanced security and decentralization: Operators run AVS by validating transactions and services without a centralized authority, enhancing the security and trustlessness of the blockchain ecosystem.

- Operational cost reduction: By localizing validation and services within the ecosystem, AVS reduce the need for external resources and interactions, cutting down operational costs significantly.

- Stake-based security: Restakers provide financial backing for AVS by staking ETH, which aligns incentives and ensures a robust level of security against attacks or failures.

Farming strategies on EigenLayer

Currently, in-protocol payments for AVS and slashing conditions are not yet active. Upon activation, these features will offer additional yields but also come with potential risks.

To earn additional yield, restakers must delegate their staked ETH to a secure and reputable Operator. It’s crucial to research the specific AVS (or multiple AVS) that the Operator is validating and understand the specific slashing conditions when they go live. As this feature is not yet active, delegating to an Operator currently carries minimal risk. The goal of EigenLayer is to make it cheaper for protocols to launch services without needing to coordinate a decentralized trust mechanism. These AVS generally do not have tokens, so there is potential to earn future airdrops (in addition to $EIGEN and LRTs).

You can find a list of Operators here and see which AVS they are involved with.

Alternatively, you can deposit ETH into liquid restaking protocols to earn both $EIGEN and LRT airdrops. These protocols have different risk profiles and delegation to Operators/AVS will be done by the DAO or protocol team.

Check out TopCrypto's comprehensive video review of Exponential! See why we're the easiest way to earn yield on your crypto.

In the news

- Reasons to stay bullish ahead of the Bitcoin halving - Read

- New memecoin infrastructure set to go live at Bitcoin halving - Read

- GameFi ecosystem surging as number of daily active wallets doubled over the past year - Read

- Worldcoin plans to launch a dedicated World Chain Layer 2 later this year - Read

- OKX launches public mainnet of its Layer 2 network - Read

- DLC.Link launches new trust-minimized way to wrap Bitcoin on EVMs - Read