Hey Edge readers,

With the spot Bitcoin ETF finally approved, we wanted to dive into the numbers this week to get a sense of what’s happening under the hood. Bitcoin is still the king so its important to understand the fundamentals and key on-chain metrics.

Here's what we're covering this week:

1. What is Bitcoin? 📖

Understand the value prop for Bitcoin.

2. Bitcoin in numbers 🟠

Using on-chain data to evaluate what’s happening under the hood.

3. Let the ETF wars begin ⚖️

BlackRock leads with BTC inflows, DeFi boon and more.

Stay sharp. 🫡

- The Exponential team

What is Bitcoin?

Learn about the history of Bitcoin, why it is considered a store of value, and how to invest in BTC.

exponential.fi/blog/what-is-bitcoin

Bitcoin in numbers

As 2024 unfolds, Bitcoin stands at a pivotal crossroads, influenced by a dynamic blend of technical indicators, evolving market sentiment, and upcoming catalysts. With the spot ETF finally approved and the next halving expected in April, we're witnessing an exciting period in Bitcoin's journey. Here's a breakdown of the network using key on-chain metrics. 📊

Supply held on exchanges 📉

Similar to past trends, the supply of Bitcoin on centralized exchanges offers insights into market behavior. A decrease suggests a bullish sentiment as more investors move Bitcoin to cold storage, signaling long-term confidence. Conversely, an influx indicates potential selling pressure. Not surprisingly, the recent market rally since late 2023 has coincided with a large drawdown of Bitcoin held on exchanges.

Metric outlook: Bullish.

Source: CryptoQuant

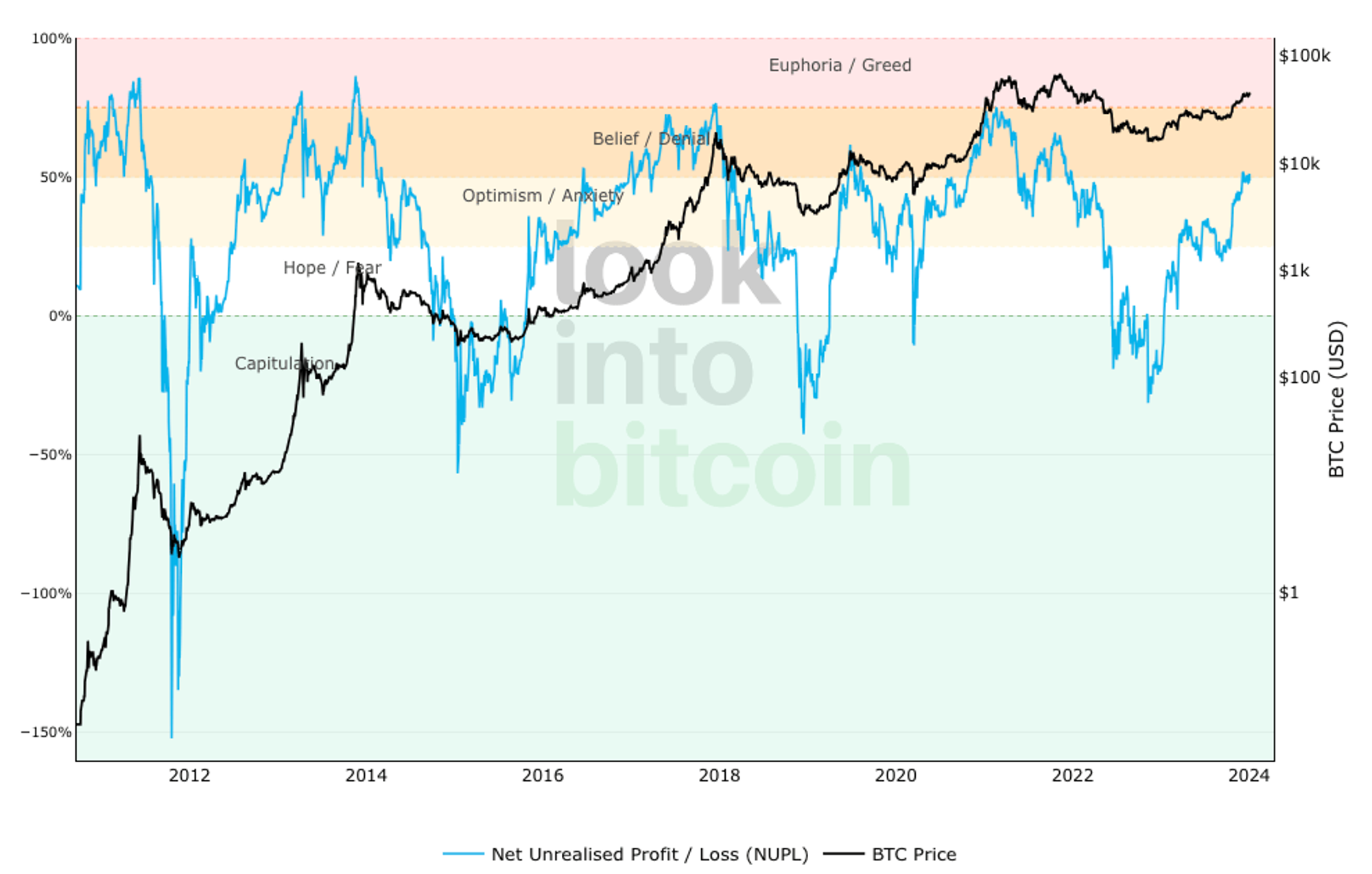

Net Unrealized Profit/Loss (NUPL)

The Net Unrealized Profit/Loss (NUPL) acts as a barometer for Bitcoin's market sentiment by comparing the current price with the last moved price of each coin—reflecting the average profit or loss of all holders. The current NUPL level indicates a market of cautious optimism, where investors are in profit but not overwhelmingly so. This suggests that investors might be contemplating whether to take profits or hold out for potential further gains. As we've observed a decrease in Bitcoin on exchanges, indicative of a bullish sentiment, the NUPL's current state points to a market that is optimistic but not irrationally exuberant.

Metric outlook: Neutral.

Source: Look Into Bitcoin

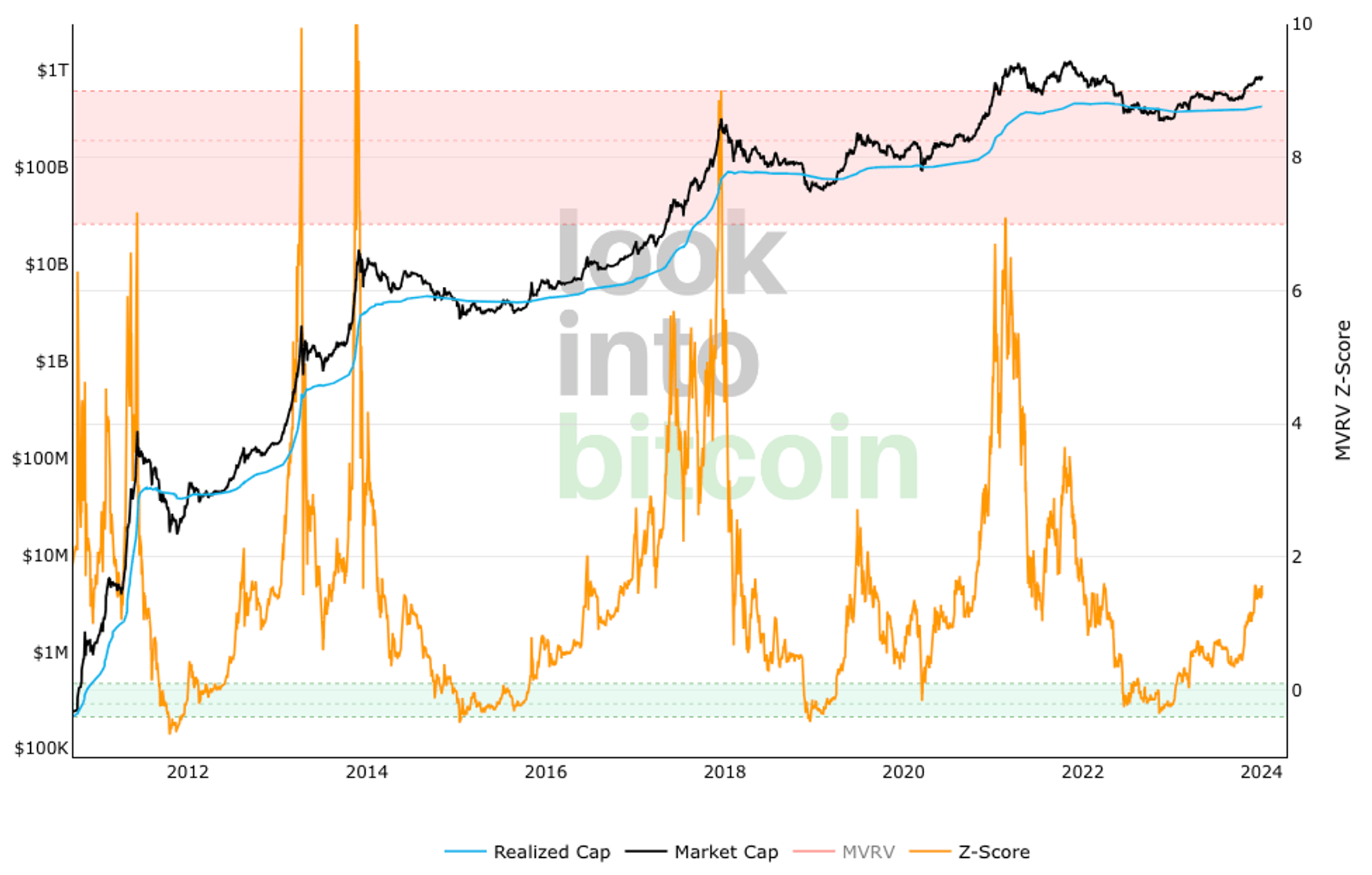

Market Value to Realized Value (MVRV) ratio

The Market Value to Realized Value (MVRV) ratio, a crucial metric for assessing Bitcoin’s valuation, compares its market value—a reflection of the current price times the coins in circulation—to its realized value, which averages the prices at which each coin was last moved. Historically, a high score has indicated market tops, like in 2018 and 2021, while a low score has signaled prime buying opportunities. Today, the score is nowhere near the red band at the top.

Metric outlook: Bullish

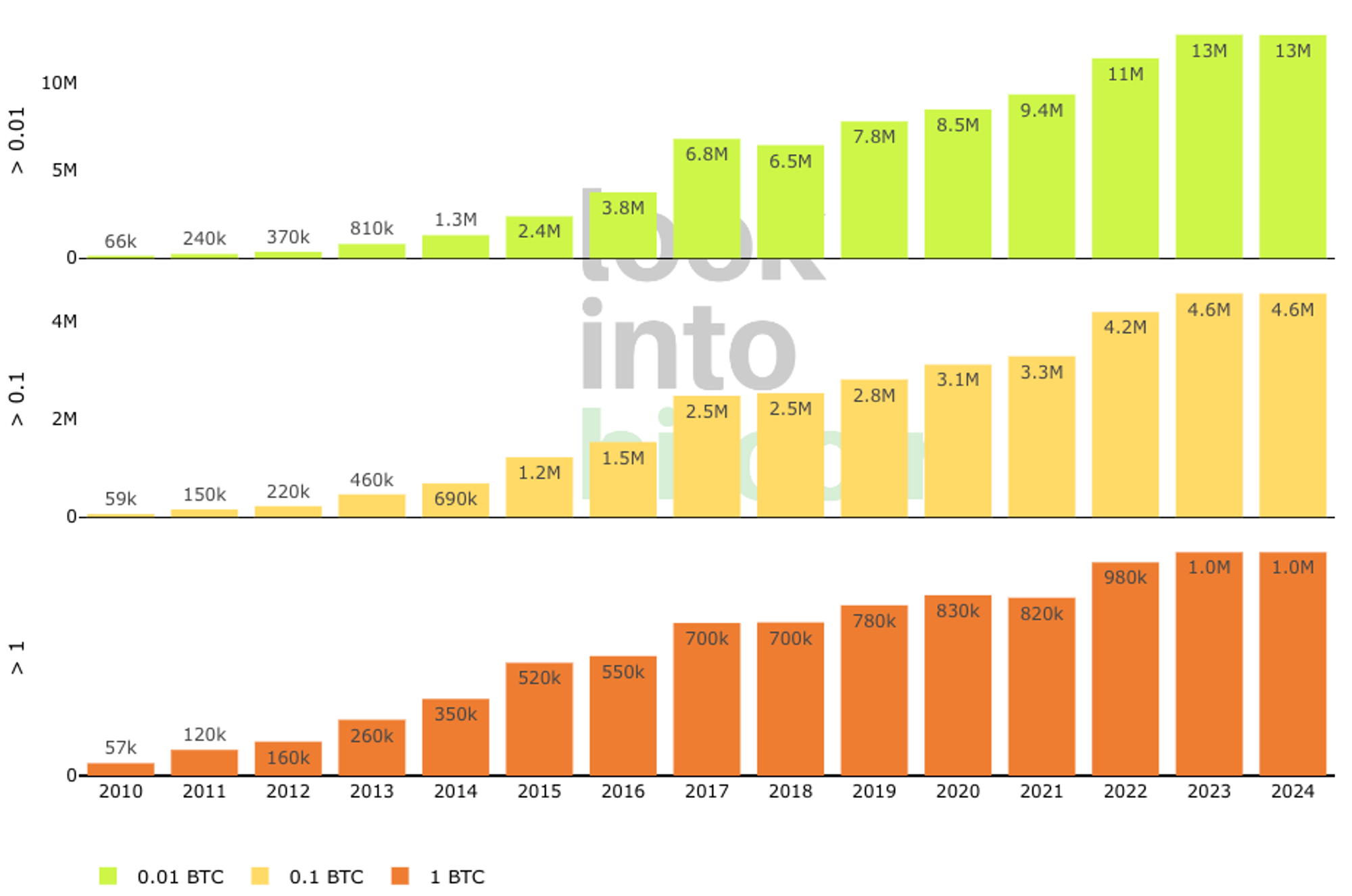

HODLer growth

The chart below illustrates the number of Bitcoin addresses holding at least 0.01, 0.1, and 1 BTC per year, offering a broad indication of Bitcoin adoption trends. Despite its imperfections—since individuals may control multiple addresses and large entities like exchanges can skew the data—the increasing number of addresses suggests a rising interest in Bitcoin holding across these thresholds. This consistent uptick, particularly in wallets holding ≥1 BTC, can be interpreted as a proxy for growing user engagement and a wider embrace of Bitcoin as a store of value.

Metric outlook: Bullish.

Conclusion

As we analyze these metrics, it’s evident that the Bitcoin network is exhibiting signs of maturation and increasing investor confidence. The bullish trends in supply dynamics, the MVRV ratio, and HODLer growth are promising indicators of a robust and resilient market. Understanding these metric could prove vital for investors looking to navigate the upcoming market shifts strategically. We’ll continue to monitor these metrics as we head into the next halving event in April, and keep you guys updated. 🫡

Exciting news from Exponential! 🌟

We're thrilled to announce the launch of our rewards pools, starting with our inaugural Bitcoin (BTC) pool, leveraging the power of DeFi.

Transform your BTC holding strategy from just HODLing to earning! With our BTC pool, you can now amplify the potential of your Bitcoin by generating yield through DeFi's innovative mechanisms.

It's time to elevate your Bitcoin game. Dive into the world of DeFi with Exponential and start making your BTC work harder for you. 🚜

In the news

- BlackRock leads the ETF pack with $1B AUM in just one week - Read

- JPMorgan anticipates substantial capital inflow from other crypto products into spot Bitcoin ETFs - Read

- Bitcoin developers advocate for change to enhance the network - Read

- Fidelity sees potential Fed rate cuts as a boon for institutional interest in DeFi - Read